A man shelters from the rain under an umbrella as he walks past the Euro currency sign in front of the former European Central Bank (ECB) building in Frankfurt am Main, western Germany.

Kirill Kudryavtsev | Afp | Getty Images

The European Central Bank is set to hold interest rates at their current record high after its monetary policy meeting on Thursday — while investors are hungry for guidance on possible rate cuts.

They may be disappointed.

“The January ECB meeting this Thursday is, as usual, unlikely to deliver any policy changes or major policy messages, involving instead a reflection on the year ahead,” economists at Société Générale said in a Tuesday note.

Minutes from the ECB’s December meeting, released last week, showed that the central bank is highly unlikely to hike rates again, but that any discussion of easing is considered premature. The minutes suggest a status quo until at least June, Société Générale said.

Markets are nonetheless pricing in around a 60% probability of the first rate cut taking place in April, according to a Reuters analysis of LSEG data. High expectations for a March cut have been pushed back in recent weeks, but April pricing is staying put despite numerous ECB officials arguing that trims may be premature.

Dutch Central Bank President Klaas Knot told CNBC at the World Economic Forum in Davos last week that current market bets could be “self-defeating,” because “the more easing the market has already done for us, the less likely we will cut rates.”

ECB President Christine Lagarde told Bloomberg that she agreed with those who see a summer cut as likely, but stressed at the time that she remained “reserved” and data dependent in her final outlook.

Headline euro area inflation ticked higher in December, rising to 2.9% from 2.4%, largely due to base effects from the energy market. Core inflation fell to 3.4%, from 3.6%.

Price rises have cooled faster than some central bank officials expected, even as they emphasize that the job is not yet done. Many see risks from geopolitical volatility and the labor market, along with the need to wait until late spring for European wage negotiations to conclude.

Spring cut?

“Lower inflation and more balanced inflation risks” make the case for a policy pivot in April and cuts amounting to 125 basis points this year, economists at BNP Paribas said in a note out last week.

“The ECB will suggest on 25 January that it is closer to starting its normalisation cycle, we expect, but without signalling an imminent rate cut, nor declaring victory in the inflation fight,” they said.

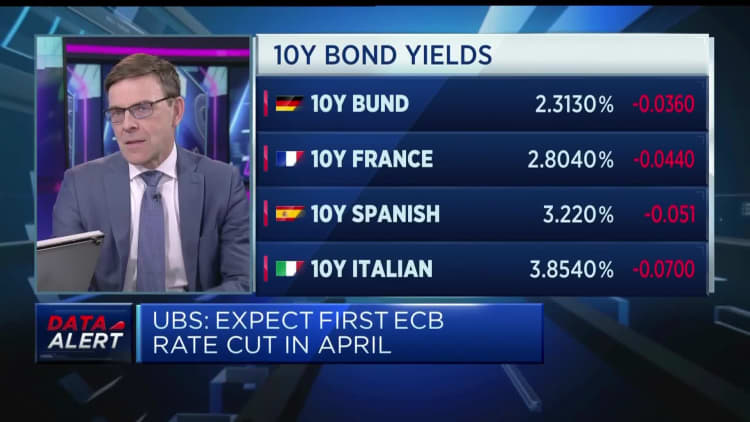

UBS is calling an April cut — but not with confidence, Reinhard Cluse, chief European economist at UBS, told CNBC’s “Street Signs Europe” on Wednesday.

“I think you cannot be very confident about an April rate cut. We previously expected June, but then brought it forward to April,” he said, noting the need for further data releases.

“Now, indeed, with the hawkish commentary, particularly in Davos, we have signaled that the risks to our call that the first cut will already come in April has certainly increased,” Cluse said, adding that the ECB’s March meeting would be more significant than January’s due to the release of new staff projections on wages and growth.

Economists at Berenberg disagree with current pricing for a 25-basis-point cut in April and nearly 150 basis points of rate trims across 2024. The need to wait for wage data in April and May, as well as for a full set of growth and inflation staff projections at the end of the first quarter, makes it more realistic that cuts will take place in June, rather than in April, the analysts said in a Tuesday note.

Berenberg expects inflation to reaccelerate next year and for labor shortages to prevent a sustained fall in wage inflation, capping the ECB’s potential to ease policy.

Société Générale economists are taking an even more cautious approach.

“We have moved our first rate cut from December to September, but there is high uncertainty as regards the data, implying that no cuts this year is also a possibility,” they said Tuesday.

The comments echo those of ECB arch-hawk Robert Holzmann, who said at Davos that he “cannot imagine that we’ll talk about cuts yet, because we should not talk about it. Everything we have seen in recent weeks points in the opposite direction, so I may even foresee no cut at all this year.”

Credit: Source link