Akihiko Matsuura, president of UA Zensen, center, raises his fist with members of the union during a rally for the annual wage negotiations in Tokyo, Japan, on Thursday, March 7, 2024.

Bloomberg | Bloomberg | Getty Images

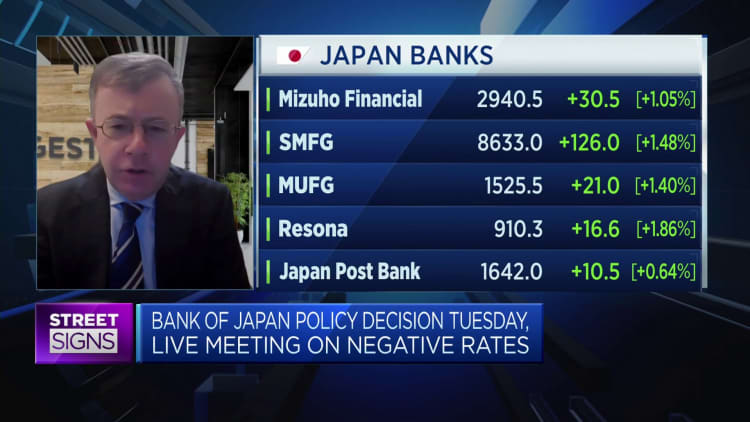

Japan is likely to see the sharpest wage hikes in 33 years following “shunto” negotiations that prompted the country’s central bank to raise interest rates for the first time in 17 years on hopes that higher salaries will fuel domestic demand and drive inflation.

But will the “shunto” hikes really work for its legions of salarymen?

The first estimate from the Japanese Trade Union Confederation, or Rengo, indicated that its seven million members would receive 5.28% in salary increments in fiscal year 2024, including a base pay rise of 3.7%.

Unionized workers that are expected to receive the pay bump though made up just 16.3% of Japan’s workforce — a record low — as of June 2023, according to the Japan International Labour Foundation.

However, headline inflation, which has been above the Bank of Japan’s 2% target since April 2022, hits the entire population.

This means that the generous pay raise negotiated by the unions leave out almost 84% of Japan’s workforce.

Richard Kaye, portfolio manager at asset management group Comgest told CNBC in an interview last month that it was “important to bear in mind that the shunto only captures a fraction of Japanese workers, it does not reflect the overall inflation picture of Japan.”

The recent wage negotiations are also likely to benefit mostly workers in large Japanese companies, while employees at small and medium enterprises might have to face rising prices without a commensurate hike to their salaries.

Smaller companies, bigger worries

The JILF report also revealed that unionized employees were mostly from large companies: companies with 1,000 or more employees had 39.8% of their workers unionized, and made up 67.3% of total union membership in the country.

In contrast, companies with 100 to 999 employees had just 10.2% of the workers unionized, while for firms with less than 99 employees the rate was 0.8%.

A survey by credit agency Tokyo Shoko Research of 4,527 companies between Feb. 1 and 8 found that 85.6% of Japanese companies plan to raise wages in 2024.

However, there was an 8.2 percentage point difference between large companies (93.1%) and small- and medium-sized enterprises (84.9%), “indicating a growing polarization due to differences in their ability to raise wages and profitability,” the survey said.

“I speak every day with companies that are trying to raise prices in Japan. It’s actually not as clear a picture, as some people would suggest… 80% of Japanese people work in companies which for a variety of reasons really can’t raise wages that much,” Comgest’s Kaye said.

On March 14, Reuters reported the case of trucking firm owner Ikuko Sakata, who said that despite facing a tight labor market and soaring demand, she could “barely afford to make ends meet” due to inflation.

The Tokyo-based company that she runs pays its nearly 80 employees the minimum wage, putting their base salaries at around 280,000 yen ($1,900) a month before overtime, the report added.

This is because to afford raising salaries, smaller firms will have to pass on costs, which could mean losing business from customers or the larger firms who contract them. “We do try to negotiate price increases, but they’re never met in full,” she said. “At best it’s 50%, and most of the time, it’s 20% to 30%.”

However, Kei Okamura, Japanese equities portfolio manager at Neuberger Berman, has a slightly different view. He said while the increases are seen at the large companies now, there would be a trickle down effect that will benefit the smaller companies.

“Obviously, the large cap exporters are going to be the first ones to benefit, given the weak yen is helping their bottom line and as a result, they’re able to pay more for wages … [but] if the large caps begin at this pace, we should see this [wage hikes] coming down into the small to mid sized space.”

Okamura also pointed out the current Kishida government is also “very eager” to get large companies to respond to smaller-cap firms’ negotiations to pass through costs, which could help smaller companies raise prices and, therefore, wages for their employees.

The pay bump is expected to prompt a virtuous cycle with people likely spending more, fueling consumption and driving prices higher in an economy that has suffered from deflation for decades.

A virtuous cycle is expected to lead to sustainable growth in the Japanese economy, which has been in the doldrums since 1990 when its asset bubble burst.

According to data from the World Bank and CNBC’s calculations, Japan’s average GDP growth from 1990 to 2022 came in 0.94%, compared with the global average GDP growth of 2.91% over the same period.

Credit: Source link