Good morning. How are finance leaders preparing their teams to meet today’s complexities and build for the future?

Deloitte’s inaugural Finance Trends report draws on a global survey of 1,326 finance leaders—mostly CFOs or next-in-line finance chiefs from companies with annual revenues above $1 billion—and interviews with nine global finance executives.

Along with an in-depth analysis of the survey data, the report explains the top five finance trends through 2026, identified by respondents and interviewees:

Scenario planning and agile governance:

Finance chiefs are balancing cost efficiency with growth investments, while supply chain disruptions remain a major source of volatility and cost. Roughly 75% of respondents say their companies lack sufficient resources for investment, and priorities are tightly clustered: Planning for external challenges, adopting new technologies, and reducing costs all ranked nearly evenly at the top.

Finance leaders have become the company strategy leaders

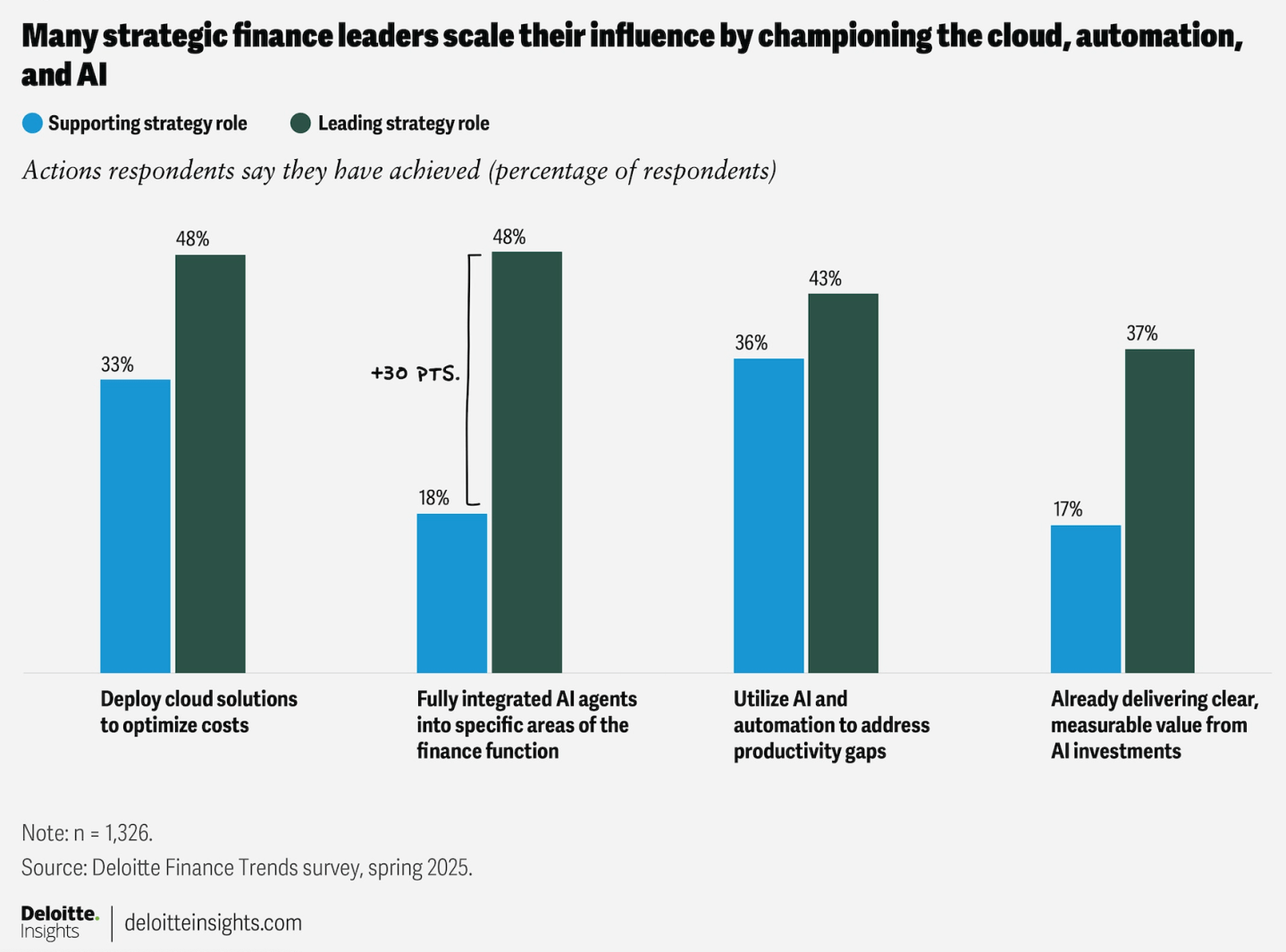

Most respondents (57%) say they are now primary strategy influencers at their organizations. Many scale their impact by deploying technology and AI, redefining finance as a proactive business partner. Nearly half (48%) of these leaders use cloud solutions to optimize costs, compared to 33% of those in support roles.

At HPE, for example, finance’s use of AI has been transformative. CFO Marie Myers told Deloitte: “We are using AI to empower our teams to become strategic partners, leveraging data and technology to drive enterprise-wide value. We’ve reimagined the role of finance, moving from traditional stewardship to proactive leadership enabled by digital transformation.”

Courtesy of Deloitte

Finance-led cost management drives measurable value

Finance leaders who own cost management—and emphasize accountability and effective tools—are more likely to meet or exceed savings goals. Thirty-six percent of surveyed finance leaders (and 42% of CFOs) are primarily responsible for cost management; 47% of these leaders consistently hit cost-savings targets, compared to 39% in supporting roles.

Finance teams are leaning into AI, but lagging on integrating AI agents

Nearly all finance teams are experimenting with AI; 63% have already fully deployed and are actively using AI solutions in their finance function. Among those respondents, only 21% believe those AI investments have already delivered clear, measurable value, and only 14% have reached the additional milestone of fully integrating AI agents directly into the finance function. This may highlight the challenge of moving from AI pilot projects to embedding AI into daily finance operations. It also shows that many industries are still in the early stages of adopting AI agents for specific tasks—a relatively new frontier in the field, according to Deloitte.

Forty-one percent of early-stage teams report legacy technology as a barrier to AI adoption, compared with 31% of “AI leaders”—respondents who have deployed AI solutions, delivered measurable value from those solutions, and have already integrated AI agents into the finance function.

The survey also found that 30% of finance leaders in the early stages of AI adoption struggle with justifying ROI, compared with 21% of those further along the AI journey, or AI leaders. Deloitte recommends that finance leaders take a holistic view of AI’s value, including trust and organizational sentiment—not just financial metrics—to ensure transformation succeeds.

Infusing tech talent in finance

Many finance departments now see technology as a key solution when talent is in short supply, and finding the right mix of both is increasingly a top priority. Nearly two-thirds of respondents (64%) plan to add more technical skills by 2026, prioritizing AI, automation, data analysis, and technology integration. For tax and finance professionals, AI skills are increasingly seen as essential.

How are you preparing your teams for this transformation in finance? Email me to share your thoughts.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Anthony Coletta was appointed CFO of Sprinklr (NYSE: CXM), a customer experience management platform. Coletta has more than 20 years of experience. Most recently, he served as chief investor relations officer at SAP SE. Before this, Coletta served as CFO for SAP North America. He also served in several other leadership roles, including CFO for SAP Latin American and Caribbean, CFO of Market Units, and chief controlling officer of Global Sales, Global Customer Operations. Before his SAP career, Coletta held various finance and strategy positions at Siemens and ThyssenKrupp.

Gibb Witham was appointed president and CFO of Hack The Box (HTB), a cybersecurity training and upskilling platform. Witham brings two decades of experience at the intersection of finance, strategy, and cybersecurity. He joins HTB from Paladin Capital Group, a cybersecurity-focused investment firm and early investor in HTB. At Paladin, Witham led investments in high-growth cybersecurity, AI, and enterprise infrastructure software companies across the U.S. and Europe. He will now lead HTB’s global financial operations and growth strategy.

Big Deal

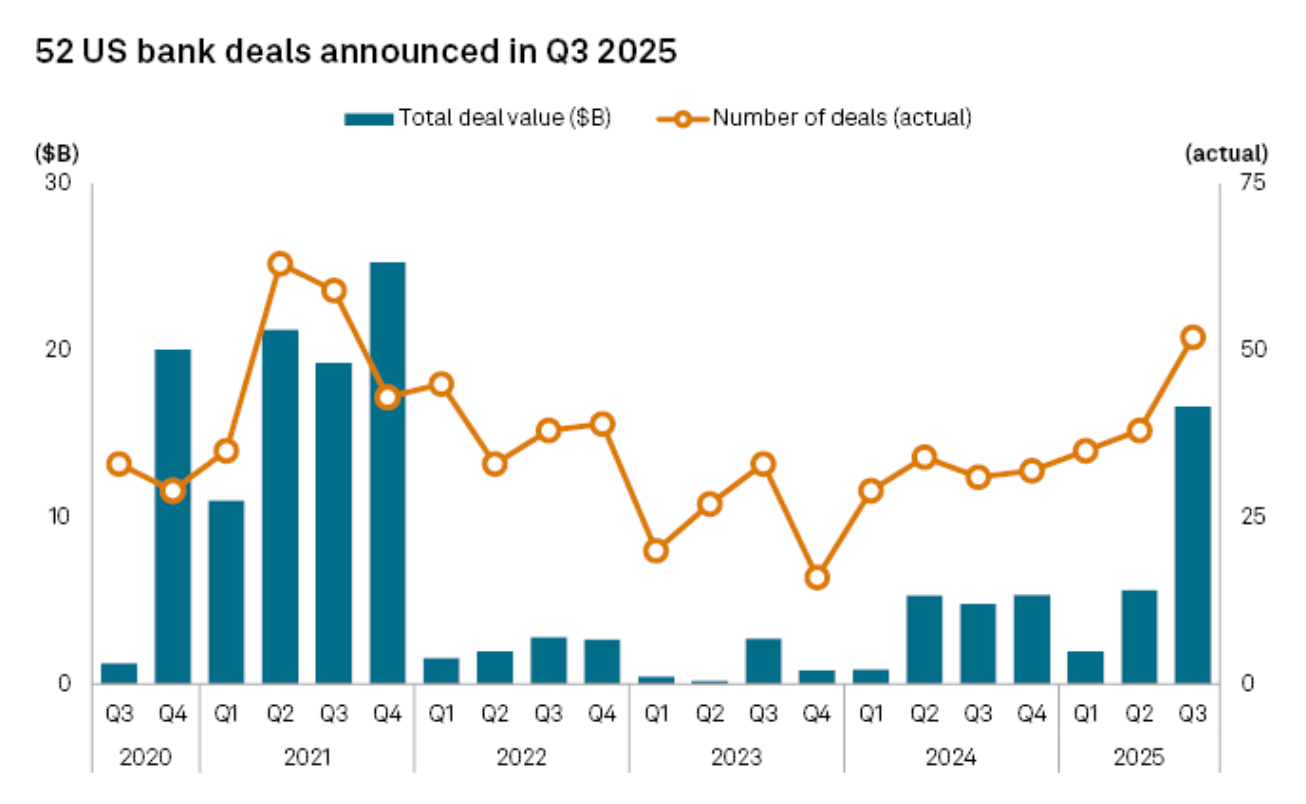

S&P Global Market Intelligence data through Sept. 30 finds that U.S. bank M&A activity reached a four-year high in Q3 2025, with 52 deals announced. This is the highest quarterly number since Q3 2021. The research finds that the total deal value for the quarter was $16.63 billion, the largest since Q4 2021, when $25.26 billion worth of deals were disclosed.

Three of 2025’s 20 largest deals were announced last month. PNC Financial’s $4.04 billion acquisition of FirstBank accounted for 79% of September’s $5.11 billion aggregate deal value. With a deal value-to-tangible common equity ratio of 234.2%, it’s the priciest U.S. bank M&A deal since 2021, according to the report.

Going deeper

“How Nonlinear Pricing Flips the Script on Markups and Efficiency” is a new report in Wharton’s business journal that explains how nonlinear pricing differs from linear pricing, where the price remains the same regardless of quantity. In contrast, nonlinear pricing, common in the real world, means the price changes with the amount you buy. Most macroeconomic models overlook this and assume firms set just one price. This concept is explored in the recent paper “Nonlinear Pricing and Misallocation,” by Wharton finance professor Gideon Bornstein and NYU economics professor Alessandra Peter. Bornstein and Peter show that when nonlinear pricing is accounted for, economic conclusions change significantly.

Overheard

“So why go public? The answer is that there are great benefits to being a listed company in a deep, global market. While there are plenty of capital options besides going public, public markets help companies grow up.”

—Sarah Keohane Williamson, CEO of FCLTGlobal, writes in a Fortune opinion piece, titled “The public company isn’t dead, it’s misunderstood.”

Credit: Source link