America’s $38 trillion national debt isn’t really because of bad math or budgeting, top economist Barry Eichengreen says. It isn’t because of interest rates, or an aging population, or even runaway spending, necessarily.

The problem is us. Or more specifically, he told Fortune in an exclusive interview, it’s a polarized political system that reflects, then amplifies, our divisions.

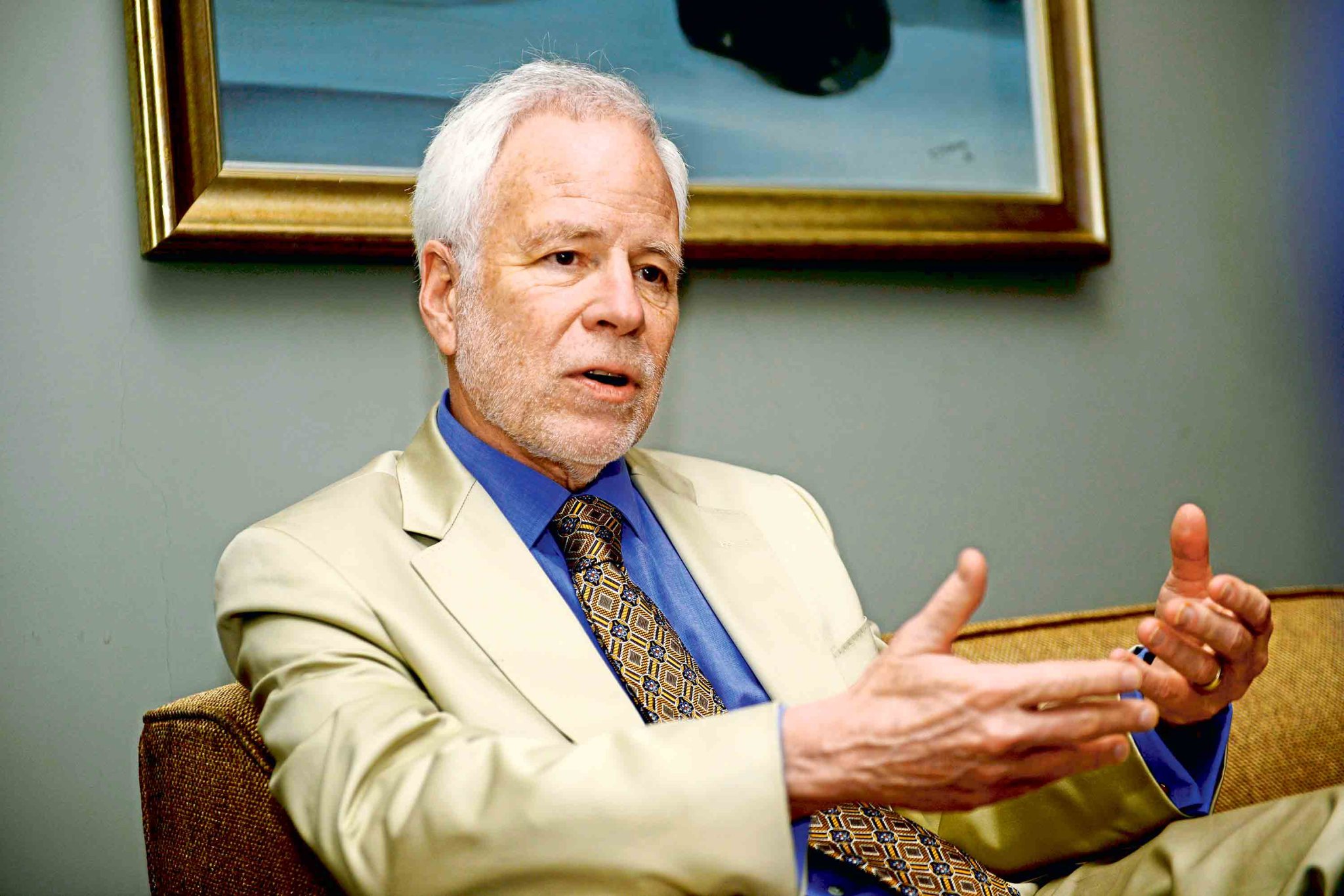

“The United States has forgotten the importance of fiscal discipline,” the Berkeley professor of nearly 40 years told Fortune. “Neither party is serious about trying to cut the budget deficit. There is lots of hand-waving and rhetoric, but very little meaningful action.”

Eichengreen expanded in conversation with Fortune on his new Peterson Foundation essay that traces 24 uninterrupted years of rising U.S. federal debt—now at $38 trillion and over 100% of GDP—and concludes that polarization is the binding constraint preventing any credible fiscal strategy. The U.S., he warned, resembles the highly indebted, politically fragmented economies of southern Europe more than policymakers in Washington want to admit.

“The comparison between the United States and Italy or Greece… those parallels are closer and more alarming today than at any point in my lifetime,” he said. “The politics become more and more polarized over time, and fiscal policy becomes trapped.”

None of the old debt-reduction playbooks work anymore

Eichengreen argues that the two major U.S. success stories—post-World War II and the 1990s—rested on three pillars: strong economic growth, favorable interest rates, and the political capacity to run primary surpluses.

“Everything has changed” in the 2020s, he said.

First – absent the markets’ “AI hopes,” Eichengreen said, growth on the whole is weaker. Second, we’re no longer in the era of ultra-low interest rates that helped previous debt consolidations; rates now are structurally higher, relative to growth. Third, the political system is unable to produce sustained surpluses: that might be a historical artifact relegated to the 20th century, he suggested.

The problem though, is not a failure of economic imagination, Eichengreen argues. It’s a failure of political capacity.

“Political polarization is higher in the United States than in any other advanced country for which we have comparable data,” he said. “It is deeply debilitating in terms of our ability to achieve consensus and stability and productive policy results.”

Eichengreen said his research shows that the countries that have successfully tamed high debts—even painful ones—share one trait: bipartisan agreement. “Low polarization is the only factor robustly correlated with successful debt consolidation,” Eichengreen said. “We [the United States] simply do not have that.”

There’s supporting evidence in the literature. A report from the Manhattan Institute, Getting to Yes, analyzes 14 major U.S. deficit-reduction negotiations since 1980 and finds that successful fiscal deals require at least two conditions: a painful “penalty default” if no agreement is reached, broad public support for deficit reduction, and genuine bipartisan trust among negotiators.

Most of those ingredients existed in the 1980s and 1990s, Eichengreen said, but have collapsed in the 2000s as partisanship has surged. Rising polarization, declining public concern about deficits, and the political untouchability of entitlements now make major fiscal consolidation far harder than in the past, the report argues.

The math is bad. The politics are worse

Indeed, the two most straightforward avenues of reducing our debt-to-GDP ratios —cutting spending and raising taxes—are politically frozen, Eichengreen said.

“We’ve learned in the last year that cutting government spending is very hard,” he emphasized. “There are pressures for defense spending. There are entitlements that are politically impossible to cut.”

Indeed, President Donald Trump tried to carve out some of the spending with the help of richest-man-in-the-world and frien-emy Elon Musk during the short-lived “DOGE” program. Musk said they ended up cutting $160 billion from the federal budget: a hefty amount, to be sure, but far short of the administrations’ goals of $2 trillion. Plus, experts now estimate that the chaos from the DOGE cuts could cost taxpayers $135 billion this year in lost tax collections and productivity.

Three-quarters of federal spending is locked into Social Security, Medicare, and defense, none of which have bipartisan support for reform.

Meanwhile, proposals for tax increases, though historically modest relative to other rich economies, are treated as off-limits.

“The U.S. remains a low-tax country,” he said. “There is scope to raise revenues by about 3% of GDP, which would cut the deficit in half. But the political system is unable to do it.”

Polarization, in other words, turns straightforward arithmetic into an unsolvable equation.

The U.S. won’t fix its debt until it fixes its politics

Eichengreen stressed that there is no “magic number” at which debt crises suddenly erupt. But he argues the country is slowly moving toward a scenario in which bond markets lose confidence, much like the UK’s 2022 Liz Truss episode.

The former prime minister triggered a financial panic in 2022 when her government unveiled a massive, unfunded tax-cut plan that markets saw as fiscally reckless. Investors dumped U.K. bonds, the pound collapsed, and the Bank of England had to intervene to prevent pension funds from imploding, all leading to Truzz eventually resigning.

“It wasn’t that Britain was about to default,” he said. “It was a sudden loss of confidence in the government’s ability to act as a reliable financial steward.”

A similarly abrupt shift in perceptions of U.S. competence, triggered by a failed auction, a political shock, or a hit to Federal Reserve independence, could force fiscal reckoning far faster than Washington expects.

But even that, he emphasized, would be a political crisis before a fiscal one.

“Every day that passes makes me feel the situation is more urgent,” Eichengreen said. “But without addressing polarization, there is no path to restoring fiscal sustainability.”

Credit: Source link