I’ll let you consider that number for a moment, because while it’s far from unprecedented (or even surprising), it is quite a chunk of change. It’s also a reminder: The firm that first made its name as a VC upstart upon its 2009 founding has become venture capital’s most-talked-about and controversial brand. And I use the term brand intentionally: a16z made its name not only by investing in companies like Skype, Facebook, and Twitter but by intentionally brand-building in a way that was new to venture in the 2010s—and now is de rigueur.

The $15 billion is being parceled out among various a16z funds. Here’s how it breaks down: The firm’s fifth growth fund gets $6.75 billion, the fifth biotech and healthcare fund will see $700 million, while the second apps fund and second infrastructure fund each get $1.7 billion. American Dynamism, a key player in the defense tech boom, gets $1.176 billion (less than I maybe would have guessed, given how hot defense tech is right now).

Finally, another $3 billion funnels to a cryptic category, “other venture strategies.” An a16z spokesperson said this “refers to a combination of things, fund strategies that have not yet launched as well as additional opportunities like institutional SMAs.” (SMAs are “separately managed accounts,” and buzzy with the family office-wealthy individual set looking for their piece of tech.)

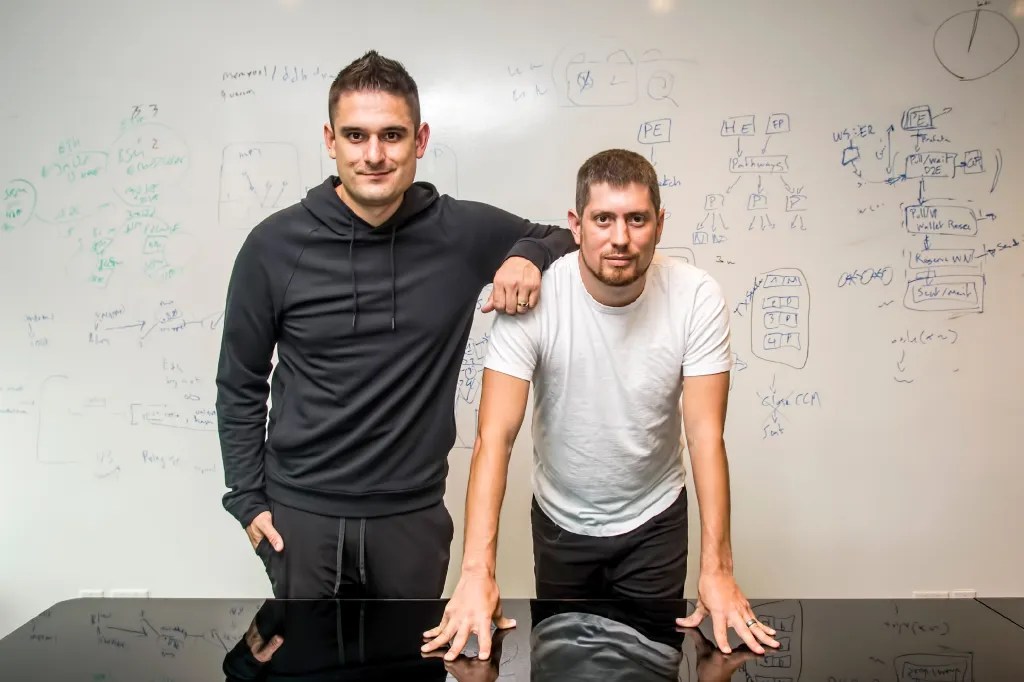

A16z has become something of a lightning rod within the tech community in recent years (the firm famously endorsed Trump ahead of the 2024 election), and make no mistake about it: This $15 billion is also geopolitical. In a blog post, cofounder Ben Horowitz says that the goal is to be investing into tech that’s “dynamic, innovative, and intensely competitive with China.” (A16z declined to make Horowitz or cofounder Marc Andreessen available for an interview.)

$15 billion is a lot of capital to put to work. But let’s also be real here: Is this number all that surprising? I would say not. VC firms are raising more and more to keep up with the AI boom (2025 global dealmaking reached $512.6 billion, says PitchBook), and we’ve seen other firms raise big funds recently (looking at you, Lightspeed, raising $9 billion).

Nor is it unprecedented on a historical basis. At the peak of the ZIRP era, in 2022, Insight raised a whopping $20 billion, while Tiger Global raised $12.7 billion. Going even further back in time, let’s not forget SoftBank, which pre-pandemic raised $100 billion for its almost comically large Vision Fund.

For years, a16z has been telegraphing its desire to be the venture-asset manager-behemoth of our future. The question, of course, is what success looks like: Is it returns, is it enduring cultural and political influence, or blunt money-deluge dominance?

See you next week,

Allie Garfinkle

X: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joey Abrams curated the deals section of today’s newsletter. Subscribe here.

VENTURE CAPITAL

– Diagonal Therapeutics, a Watertown, Mass.-based biotech company developing antibodies designed to get to the root of genetic diseases, raised $125 million in Series B funding. Sanofi Ventures and Janus Henderson Investors led the round and were joined by others.

– Corgi, a San Francisco-based AI insurance platform designed for startups, raised $108 million in funding from Y Combinator, Kindred Ventures, Contrary, and others.

– Valinor Enterprises, a Washington, D.C.-based defense and government tech company, raised $54 million in Series A funding. Friends & Family Capital led the round and was joined by existing investors General Catalyst, Founders Fund, Red Cell Partners, and others.

– Protege, a New York City-based AI data platform, raised $30 million in Series A funding. a16z led the round and was joined by Footwork, CRV, and others.

– Canopy, a Palo Alto, Calif.-based developer of safety technology for health care environments, raised $22 million in Series B funding. 111° West Capital and ACME Capital led the round and were joined by existing investors.

– Tucuvi, a New York City-based developer of an AI voice agent designed for care teams, raised $20 million in Series A funding. Cathay Innovation and Kfund led the round and was joined by existing investors Frontline Ventures, Seaya Ventures, and Shilling.

– Spangle AI, a Seattle, Wash.-based developer of an agentic infrastructure layer for commerce, raised $15 million in Series A funding. NewRoad Capital Partners led the round and was joined by DNX Ventures and existing investors Madrona Ventures and Streamlined Ventures.

– Topos Bio, a San Francisco-based developer of therapies designed for intrinsically disordered proteins, raised $10.5 million in seed funding from Boldstart, Threshold, Neo, and angel investors.

PRIVATE EQUITY

– BNP Group, backed by Godspeed Capital, acquired Airport Gurus, a Barcelona, Spain-based aviation consultancy firm. Financial terms were not disclosed.

– Currier Plastics, a portfolio company of Sheridan Capital Partners, acquired Springboard Manufacturing, a Rancho Cordova, Calif.-based plastic injection molding company for medical devices, and MOS Plastics, a San Jose, Calif.-based plastic injection molding company for medical devices. Financial terms were not disclosed.

– Fenceworks, a portfolio company of Gemspring Capital, acquired Accurate Fence, a Lawrenceville, Ga.-based fencing installation company. Financial terms were not disclosed.

– Grant Avenue Capital acquired PatientCare EMS Solutions, a Hudson, Fla.-based provider of ground-based health care transportation services. Financial terms were not disclosed.

– Haveli Investments agreed to acquire a majority stake in Sirion, a Lehi, Utah-based developer of lifecycle management software. Financial terms were not disclosed.

– L Catterton agreed to acquire a majority stake in Good Culture, an Austin, Texas-based cottage cheese brand. Financial terms were not disclosed.

– The Interprose Corporation, a portfolio company of Wingman Growth Partners, acquired Beam Software, a Sarasota, Fla.-based developer of software for debt buyers, servicers, and third-party collection agencies. Financial terms were not disclosed.

– Veritas Capital agreed to acquire a majority stake in Global Healthcare Exchange, a Louisville, Colo.-based developer of supply chain software designed to connect health care providers with suppliers. Financial terms were not disclosed.

EXITS

– Constellation acquired Calpine Corporation, a Houston, Texas-based power company, from Energy Capital Partners for approximately $26.6 billion.

– Gryphon Investors acquired Safety Management Group, an Indianapolis, Ind.-based outsourced safety services company, from NMS Capital. Financial terms were not disclosed.

– I Squared Capital agreed to acquire Ramudden Global, a Stockholm, Sweden-based traffic management and infrastructure safety company, from Triton. Financial terms were not disclosed.

– ThreatModeler, backed by Invictus Growth Partners, acquired IriusRisk, a Huesca, Spain-based threat modeling platform, from Paladin Capital Group. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

– Eir Partners Capital, a Miami, Fla.-based private equity firm, raised $1 billion for its third fund focused on health tech and tech-enabled services companies.

PEOPLE

– Left Lane Capital, a New York City-based venture capital firm, promoted Laura Sillman, Henry Toole, and Magnus Karnehm to partner. The firm also promoted Mark Shtrakhman and Alexa Tsay to Vice President.

– NewView Capital, a Burlingame, Calif.-based venture capital firm, promoted Nick Bunick to partner.

Credit: Source link