At American Express, consumers are continuing to open high-fee credit cards and splurge on luxuries like travel. But for lending firm Upstart, there’s a strong interest in microloans as cash-strapped Americans try to scrape by.

That juxtaposition underscores the growing picture of bifurcation among income brackets in America. And adds to an increasingly popular view that the U.S. is experiencing a “K”-shaped recovery since the end of the pandemic, where higher income classes reap the most benefits and lower-income Americans tread water or fall behind.

It’s led to a confusing picture of the U.S. economy that can impact everything from how the Federal Reserve will move interest rates next to who Americans will vote for in November. On top of this, some are worried it will threaten the surprisingly resilient economy that has been a worldwide marvel. And it comes at a unique moment with consumers once against leaning on debt and many beginning to crack.

“Our consumers are doing really well,” American Express CFO Christophe Le Caillec told CNBC last month, citing spending on flights and dinning out. “They’re enjoying life for sure.”

American Express’ typical consumer is affluent and is showing every sign that they are chugging along in the face of stubborn inflation and lingering economic uncertainty. More than 3 million new credit cards — which sometimes carry annual fees costing up to hundreds of dollars — were issued in the latest quarter. U.S. cardholders as a whole spent 8% more in the most recent three-month period.

First-quarter airline spending on American Express cards climbed 9% from the prior quarter, underscoring a continued willingness to pay for experiences. First-class travel has exhibited special strength, though management noted that can be tied in part to a resurgence of business trips. That too may be a good sign for white-collar workers as it shows businesses are willing to spend on travel again.

But behavior among some Upstart customers paints a different picture of the same economy. The company on Tuesday reported an 80% surge in originations of loans of up to $2,500 during the first quarter. These “relief loans,” as management describes them, have been used for expenses like rent and other regular bills, according to principal product manager Blair Lanier.

People taking these loans are more likely to be lower-income with no more than a high school diploma, Lanier said. Some may be turning to these small loans after being rejected for larger sums or by other lenders, but Upstart has also made changes to its automatic approval processes, the company said. (These loans are fixed-fee products with an annual percentage rate up to 36%.)

“The last two years have been a very sort of unique and specific and unusual event in the macroeconomy,” Lanier said. “I’m not that surprised that there is both significant existing demand for a product like this and that that demand would be visible right now.”

Struggling lower tier

Americans like those turning to Upstart’s microloans are buckling under mounting financial pressures.

The end of Covid-era fiscal stimulus along with the resumption of student loan payments have sapped the savings accumulated early in the pandemic. Rising gas costs can be particularly painful for those without remote work privileges. On the other hand, higher-income consumers also may feel emboldened by rising home prices and strength in the stock market.

Lower-income households account for a large chunk of the country’s population, which can help explain the sour economic sentiment seen broadly. The University of Michigan consumer sentiment index declined more than 12% between April and May alone as consumer expectations for future inflation rose, according to data released Friday. While the index came in far below economists’ forecasts, it was still well above where it sat at the same time a year prior.

Some economists were at a loss to explain the change in the closely watched survey but it comes at a time when many have seen rainy day funds dry up. Excess savings among Americans peaked above $2 trillion in August 2021, according to data analyzed by the San Francisco Federal Reserve. But that padding has been entirely depleted in the ensuing years as financial strain has grown, with U.S. households now cumulatively $72 billion in debt, as of March.

At the same time, costs for a variety of goods and services have risen. Though the pace of inflation has cooled from multidecade highs seen in recent years, prices continue to increase at a faster rate than monetary policymakers deem healthy for the economy.

Given these factors, economists have been puzzled by a continued propensity to spend. But the long-awaited consumer slowdown is finally showing in a host of households brands, particularly those frequented by lower-income brackets.

McDonald’s said it is adopting a “street-fighting mentality” and is “laser focused” on value after higher prices pushed away diners with less to spend. Soda and snack producer PepsiCo acknowledged that the low-income American is “stretched.”

Tyson Foods’ frozen chicken products.

Daniel Acker | Bloomberg | Getty Images

Frozen food maker Tyson Foods has seen consumers shifting more to eating at home than the quick-service restaurants it supplies. Management said the lower tax brackets in particular have switched to private labels from Tyson’s name brand when grocery shopping.

That’s part of a trend known as “trading down” that can indicate consumers are tightening purse strings. Market data provider Adobe Analytics has seen this behavior online over the past four months across numerous categories, including personal care, electronics, apparel, furniture and groceries.

Furniture e-commerce platform Wayfair said that sales of big-ticket items have been particularly weak. Tool maker Stanley Black & Decker lamented soft consumption trends and interest in do-it-yourself projects.

A hot labor market and rising wages have been pointed to as a source of optimism among this consumer base, despite growing uncertainty elsewhere. But last month’s shockingly weak jobs report and a recent jump in unemployment claims can throw some cold water on one of the last reasons for lower-income Americans to feel good about the economy.

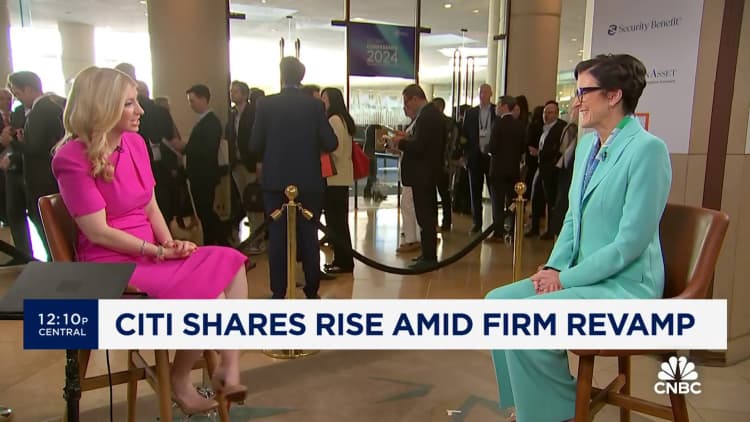

“We’re seeing a much more cautious low-income consumer,” Citigroup CEO Jane Fraser told CNBC’s Sara Eisen this week. “They’re feeling more of the pressure of the cost of living, which has been high and increased for them. So, while there is employment for them, debt servicing levels are higher than they were before.”

Fraser is one of several corporate leaders and economists pointing to the “K” shape of consumer habits. In this environment, the upper crust continues to spend, while those less well-off now grapple with elevated price tags and interest rates.

Put differently, middle- and high-income consumers are “sanguine,” while low-income consumer confidence is in “recessionary territory,” according to Nancy Lazar, chief global economist at Piper Sandler. She said this discrepancy can dash hopes for a “soft landing,” which is a goal outcome where inflation is tamed without tipping the economy into a period of prolonged contraction.

It’s also important to remember that lower-income Americans were feeling financial pressures before the pandemic, said Tyler Schipper, an associate professor of economics at the University of St. Thomas in Minnesota. While the group had made up ground amid the worker shortage, he said a return to more troubled waters makes sense as the economy continues unraveling from the 2020 shock.

“They were starting from a place of struggling,” Schipper said. “This idea that lower-income workers are going to be looking for the best prices, I think is, in some sense, a return to normalcy.”

Schipper said evidence of price matching or trading down can be good news for the Federal Reserve, which is looking for signs that previously interest rate hikes have had their intended effects of tightening the economy.

Upper class hums along

Higher earners, though a smaller segment of the population, remain on a tear, and it could make all the difference for some companies.

Airlines for years have been racing to grow business class and premium-economy cabins and expand lounges to accommodate bigger spenders. Delta Air Lines has said sales from those cabins have outpaced economy-class. New York-based JetBlue Airways, which is far smaller than its major airline rivals, said this week that it’s cutting back on some flights to instead offer more business-class seats on routes to the Caribbean.

Booking Holdings said customers aren’t sacrificing higher-rated hotels or longer vacations. Airbnb touted interest in travel to events like the Paris Olympics and the European Cup in Germany this summer.

Airbnb management highlighted the thirst for experiences among its clientele. In the same vein, Ticketmaster parent Live Nation said it’s seeing “no weakness” in demand.

Theme park chains Six Flags and Cedar Fair both saw stronger-than-expected attendance in their most recent quarters. Six Flags said that the number of 2024 season passes sold through April grew by at a double-digit pace compared with the same period a year prior.

Guests ride a rollercoaster at Six Flags Magic Mountain theme park in Valencia, California, US, on Saturday, Nov. 4, 2023.

Eric Thayer | Bloomberg | Getty Images

Unlike at Wayfair, Garmin is seeing strength in sales of its pricier products. The company pointed to the fact that its fitness segment’s revenue grew 40% from the same quarter in 2023, led by wearable technology.

“We’ve actually seen very strong response to some of our high-end products,” Garmin CEO Cliff Pemble told analysts earlier this month. “People are buying based on their needs, and we haven’t seen a lot of evidence of mixing down that we could point to with confidence.”

Where’s the weakness?

This divergence is even taking place within sectors. Look no further than Planet Fitness and Life Time.

Planet Fitness, known for its memberships starting at $10, has seen a “shift in consumer focus” to saving in 2024. For premium gym chain Life Time, clubs are running waitlists and personal training demand is at record levels.

“I have personally expected to see some weakness for the last 18 months, and I have been wrong,” Life Time CEO Bahram Akradi said to analysts this month.

— CNBC’s Kate Rooney, Amelia Lucas, Brandon Gomez, Robert Hum, Jeff Cox, Leslie Josephs and Hugh Son contributed to this report.

Credit: Source link