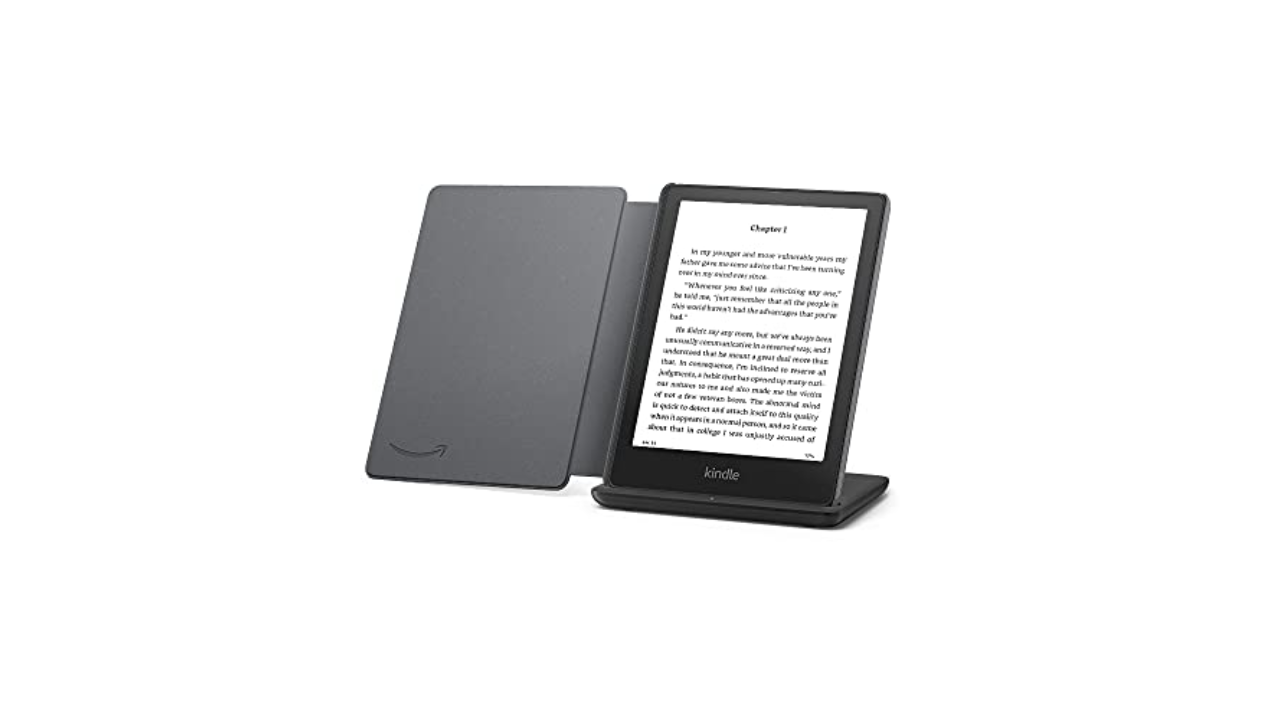

JIUJIANG, CHINA – JUNE 17: A worker manufactures seamless steel gas cylinders for export at the workshop of Sinoma Science & Technology (Jiujiang) Co., Ltd. on June 17, 2024 in Jiujiang, Jiangxi Province of China.

Wei Dongsheng | Visual China Group | Getty Images

China’s steel exports will soon hit an eight-year high, before sweeping tariffs sink in and drag down the industry in 2025, industry watchers said.

As the biggest exporter of steel, China accounts for about 55% of the world’s steel production. The country’s steel exports have been surging this year and are expected to smash through the 100 million metric ton mark, matching levels last seen in 2016.

Strategists at Macquarie Group predicted that China’s steel exports will reach 109 million tons this year, before declining to 96 million tons in 2025. Trade tariffs could further curb China’s steel exports, “albeit this may require a while to play out.”

Their predictions were echoed by analysts interviewed by Citigroup. China’s steel shipment is “skewed to the downside” from next year and onwards due to anti-dumping measures, Ren Zhuqian, an analyst from steel consultancy Mysteel, said in a Citigroup note this month.

Foreign markets have been particularly crucial amid a domestic supply glut, as China’s economy grapples with a prolonged property crisis and slowdown in manufacturing activities.

In September, China’s steel exports jumped 26% from a year ago to 10.2 million tons, surpassing the 10 million ton a month benchmark that was last hit in June 2016. In the first nine months of the year, exports rose 21.2% year on year to 80.7 million tons, according to the customs data last week.

After hitting a record high of 112 million tons in 2015, the country’s steel exports had been on a multi-year slide before it started improving in 2020.

Steel export growth has accelerated ever since, propelled by a lack of domestic demand, even as overall export growth in China slowed sharply in September on the back of a series of disappointing data that pointed to a weak economy.

Anti-dumping ‘Wac-A-Mole’

Floods of cheap steel from China had sparked concern among its trading partners of unfair competition for domestic steelmakers. More and more have ramped up anti-dumping measures, including hefty tariffs.

Steel producers in importing countries have been “under massive strain,” said Chim Lee, senior analyst at the Economist Intelligence Unit, especially those in Southeast Asia and the Middle East.

Thailand expanded anti-dumping duties to 31% on hot-rolled coil, high-strength steel used for critical infrastructure construction, from China in August. Mexico imposed a nearly 80% tariff on some Chinese steel imports late last year.

This month, Brazilian government imposed a 25% tariff on all steel products from the country. And Canada’s 25% surtax on Chinese steel products, which it announced in August, came into effect on Tuesday.

These kinds of protectionism measures tend to have short-lived impacts, said Tomas Gutierrez, head of data at consultancy Kallanish Commodities, as steel exporters resort to measures such as “circumvention,” shaking off the China-label by making transits through a third-party country.

We see a ‘whac-a-mole’ scenario: when one country starts to limit steel imports from China, Chinese steel producers are likely to redirect them to another country until that market, too, imposes new trade restrictions.

Chim Lee

Senior analyst, Economist Intelligence Unit

But Vietnam’s ongoing anti-dumping probe into hot-rolled coil could derail China’s export momentum as it “impacts a much higher volume of Chinese steel,” Gutierrez said.

Vietnam is a major importer of Chinese steel, consuming about 10% of the country’s steel exports in 2023, according to a Mysteel report. Other top destination markets include Thailand, India and Brazil.

Last month, Indian government ordered tariffs of between 12% and 30% on some steel products imported from China and Vietnam, escalating an anti-dumping duty it imposed on Chinese steels last year.

“We see a Whac-A-Mole scenario,” EIU’s Chim said. The tariffs lead Chinese steel producers to redirect to alternative markets, “until that market, too, imposes new trade restrictions.”

U.S. President Joe Biden’s administration called for tripling tariffs on Chinese steel in April, and Republican presidential nominee Donald Trump said he could raise tariffs by 60% on Chinese goods if re-elected next month.

But the impact of these threats from Washington would be rather limited, as less than 1 percent of Chinese steel exports, worth $85 billion, were shipped to the U.S. in 2023.

Dwindling demand

For the first time in six years, the World Steel Association this month forecast that China’s domestic steel demand this year would account for less than half of global demand, citing “the ongoing downturn” in the country’s real estate sector.

China’s property-related steel demand may not see a substantial improvement until 2025 or 2026, EIU’s Chim said, as Beijing seeks to curb new housing supplies while clearing existing housing inventories.

New construction starts, the most steel intensive part of the property construction process, will continue to be very weak, Chim said.

Meanwhile, he added, state-led infrastructure investment, which has increasingly pivoted away from roads and railways to energy infrastructure, is unlikely to fill the gap left by home builders.

More domestic steelmakers had scaled back production given poor profitability on steel sales. Almost three-quarters of Chinese steel companies reported losses in the first six months this year, with many at risks of bankruptcy.

China’s production of medium-thick hot-rolled coil — a proxy of flat steel products — fell 5.4% from the prior month in September, and 6.4% on year, according to S&P Global, which cited official customs data.

On escalating trade tensions, a spokesperson for China’s customs administration said a majority of Chinese steel products were to meet domestic demand, before receding that the hard-rolled coils “would have broad appeal in overseas market,” due to continuous innovation and product upgrades in the industry.

A possible tax crackdown

Beijing’s possible crackdown on value-added tax could make matters worse for China’s steel industry.

This year, steel mills have been under pressure from regulators over allegations that they skirted taxes to make exports even cheaper.

Authorities had set up an investigative team to crack down on these “illegal” steel exports, Luo Tiejun, vice president of the state-backed Iron and Steel Industry Association, said in a meeting last week.

“If China really followed through [with the investigation], Chinese exports would be much less competitive and export volumes could come down,” Gutierrez said. But the government may not have the “confidence” for that yet.

Clarification: This story has been updated to clarify that predictions of China’s steel export in 2024 and 2025 are from metal strategists at Macquarie Group.

Credit: Source link