Federal Reserve Chair Jerome Powell on Friday called for more vigilance in the fight against inflation, warning that additional interest rate increases could be yet to come.

While acknowledging that progress has been made and saying the Fed will be careful in where it goes from here, the central bank leader said inflation is still above where policymakers feel comfortable. He noted that the Fed will remain flexible as it contemplates further moves, but gave little indication that it’s ready to start easing anytime soon.

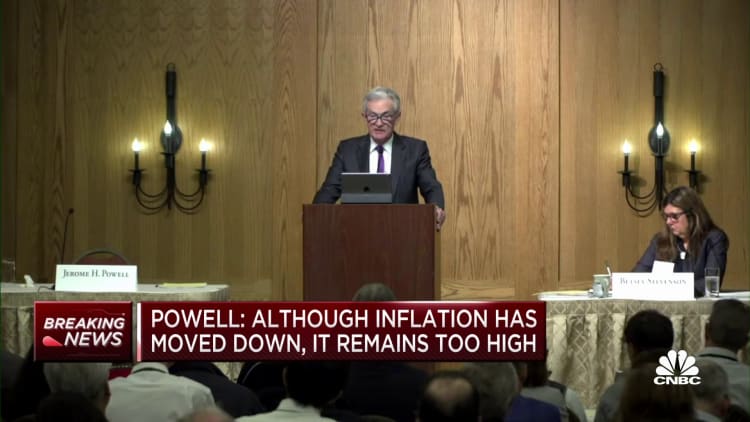

“Although inflation has moved down from its peak — a welcome development — it remains too high,” Powell said in prepared remarks for his keynote address at the Kansas City Fed’s annual retreat in Jackson Hole, Wyoming. “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

The speech resembled remarks Powell made last year at Jackson Hole, during which he warned that “some pain” was likely as the Fed continues its efforts to pull runaway inflation back down to its 2% goal.

But inflation was running well ahead of its current pace back then. Regardless, Powell indicated it’s too soon to declare victory, even with data this summer running largely in the Fed’s favor. June and July both saw easing in the pace of price increases, with core inflation up 0.2% for each month, according to the Bureau of Labor Statistics.

“The lower monthly readings for core inflation in June and July were welcome, but two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” he said.

Powell acknowledged that risks are two-sided, with dangers of doing both too much and too little.

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment,” he said. “Doing too much could also do unnecessary harm to the economy.”

“As is often the case, we are navigating by the stars under cloudy skies,” he added.

Markets were volatile after the speech, with the Dow Jones Industrial Average off its highs of the session and Treasury yields rising. In 2022, stocks plunged following Powell’s Jackson Hole speech.

“Was he hawkish? Yes. But given the jump in yields lately, he wasn’t as hawkish as some had feared,” said Ryan Detrick, chief market strategist at the Carson Group. “Remember, last year he took out the bazooka and was way more hawkish than anyone expected, which saw heavy selling into October. This time he hit it more down the middle, with no major changes in future hikes a welcome sign.”

A need to ‘proceed carefully’

Powell’s remarks follow a series of 11 interest rate hikes that have pushed the Fed’s key interest rate to a target range of 5.25%-5.5%, the highest level in more than 22 years. In addition, the Fed has reduced its balance sheet to its lowest level in more than two years, a process which was seen about $960 billion worth of bonds roll off since June 2022.

Markets of late have been pricing in little chance of another hike at the September meeting of the Federal Open Market Committee, but are pointing to about a 50-50 chance of a final increase at the November session. Projections released in June showed that almost all FOMC officials saw another hike likely this year.

Powell provided no clear indication of which way he sees the decision going.

“Given how far we have come, at upcoming meetings we are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks,” he said.

However, he gave no sign that he’s even considering a rate cut.

“At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks,” Powell said. “Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.”

He noted the risk of strong economic growth in the face of widespread recession expectations.

“It was a balanced but not trend-changing speech, even if the Fed kept the ‘mission accomplished’ banner in the closet,” said Jack McIntyre, portfolio manager at Brandywine Global. “It leaves the Fed with needed optionality to either tighten more or keep rates on hold.”

Getting into details

While last year’s speech was unusually brief, this time around Powell provided a little more detail into the factors that will go into policymaking.

Specifically, he broke inflation into three key metrics and said the Fed is most focused on core inflation, which excludes volatile food and energy prices. He also reiterated that the Fed most closely follows the personal consumption expenditures price index, a Commerce Department measure, rather than the Labor Department’s consumer price index.

The three “broad components” of which he spoke entail goods, housing services such as rental costs and nonhousing services. He noted progress on all three, but said nonhousing is the most difficult to gauge as it is the least sensitive to interest rate adjustments. That category includes such things as health care, food services and transportation.

“Twelve-month inflation in this sector has moved sideways since liftoff. Inflation measured over the past three and six months has declined, however, which is encouraging,” Powell said. “Given the size of this sector, some further progress here will be essential to restoring price stability.”

No change to inflation goal

In addition to the broader policy outlook, Powell honed in some areas that are key both to market and political considerations.

Some legislators, particularly on the Democratic side, have suggested the Fed raise its 2% inflation target, a move that would give it more policy flexibility and might deter further rate hikes. But Powell rejected that idea, as he has done in the past.

“Two percent is and will remain our inflation target,” he said.

That portion of the speech brought some criticism from Harvard economist Jason Furman.

“Jay Powell said all the right things about near-term monetary policy, continuing to hope for the best while planning for the worst. He was appropriately cautious on inflation progress & asymmetric about the policy stance,” Furman, who was chair of the Council of Economic Advisers under former President Barack Obama, posted on X, the social media site formerly known as Twitter. “But wish he had not ruled out shifting the target.”

On another issue, Powell chose largely to stay away from the debate over what is the longer-run, or natural, rate of interest that is neither restrictive nor stimulative – the “r-star” rate of which he spoke at Jackson Hole in 2018.

“We see the current stance of policy as restrictive, putting downward pressure on economic activity, hiring, and inflation,” he said. “But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint.”

Powell also noted that the previous tightening moves likely haven’t made their way through the system yet, providing further caution for the future of policy.

Credit: Source link