The Big Opportunity for Individuals

Investing in startups used to be reserved for the wealthy or well-connected individuals. However, with the rise of crowdfunding model, anyone can invest in startups and potentially reap huge returns.

When a startup becomes successful and reaches unicorn status, the value of the company increases. This means that investors who invested early on can sell their shares at a higher price and make a profit. Alternatively, investors can hold onto their shares and wait for the company to go public or be acquired, which can lead to even bigger returns. Investing in startups is a long-term strategy that requires patience and a willingness to take risks, but it can pay off in a big way.

What can you do with 1,000 USD

Individuals often face limited investment options to grow their money, making it challenging to start a business with a small amount while maintaining full-time employment. Conversely, while investing in the stock market may carry lower risks, it does not guarantee returns and is not typically a path for small investors to accumulate significant wealth. Investing in startups presents an alternative investment opportunity.

How to Spot a Winning Startup

If you’re considering investing in a startup, here are some things to keep in mind:

• Do your research: Make sure you understand the company’s business model, market potential, and management team.

• Be patient: Startups take time to grow and become successful. Don’t expect to see immediate returns on your investment.

Startups often start with a small team, limited resources, and a big idea. However, a good idea alone does not guarantee success. Startups need funding to develop their ideas, hire talent, and grow their businesses. This is where investors come in.

How Anyone Can Participate in Startup Investing

Crowdfunding is a relatively new way of raising capital that allows a large number of people to invest small amounts of money in a startup.

One advantage of crowdfunding is that it allows startups to retain control over their business at an early stage. This is because crowdfunding typically involves a large number of investors, each with a small stake in the company. In contrast, traditional investment models often involve a small number of investors with a larger stake in the company. This can lead to the loss of control for the startup founders. Additionally, crowdfunding can help startups build a loyal customer base early on, as their investors are often their first customers.

Conclusion

Investing in startups is a unique opportunity for individuals to potentially multiply their wealth by investing in innovative and disruptive ideas. While there are risks involved, the potential rewards can be huge. By investing in startups, you can become a part of the next big success story and potentially make a significant return on your investment. Whether you choose to invest in a startup through crowdfunding or by directly investing in a company, investing in startups can be a smart long-term investment strategy.

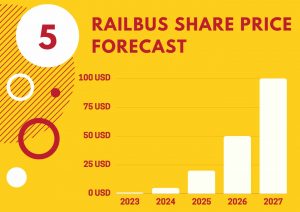

RAILBUS, An Example for a Promising Startup RAILBUS serves as a great example of an startup that investors should consider investing in . its innovative approach to a solar-powered transportation is leading to significant growth and a promising future.

RAILBUS serves as a great example of an startup that investors should consider investing in . its innovative approach to a solar-powered transportation is leading to significant growth and a promising future.

Watch this short intro video (less than 2 minutes)

Embrace a Unique Investment Opportunity in Sustainable Transit Bringing 100% Solar-Powered Mass Transportation to Life, offering Minimum $100 Entry and Potential Returns from 2X in One Year to 50X in Four Year. For more information and to join as a member and shareholder, click here