JPMorgan Chase CEO Jamie Dimon thinks there’s a better-than-even chance that the U.S. is heading for a recession, though he doesn’t see systemic issues looming.

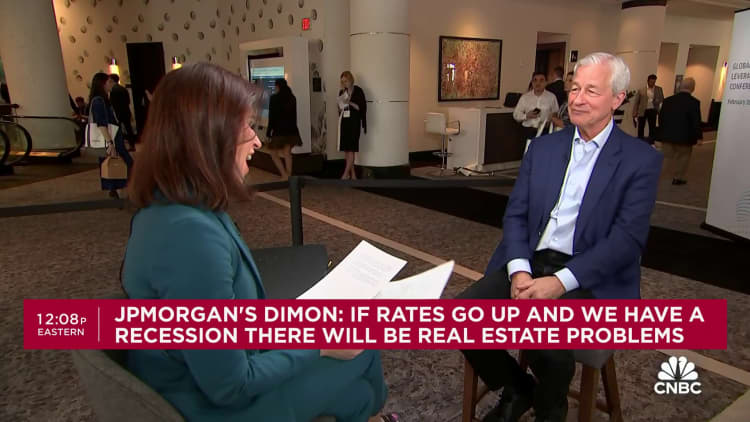

Speaking Monday from the JPMorgan High Yield and Leveraged Finance Conference in Miami, the head of the largest U.S. bank by assets said markets probably aren’t pricing in a strong enough probability that interest rates could stay higher for longer.

Dimon noted “there are things out there which are kind of concerning,” and he disagreed with the high level of probability being assigned to the economy missing a recession.

“The market is kind of pricing in a soft landing. That may very well happen,” he told CNBC’s Leslie Picker. “But the [market’s] odds are 70 to 80 percent. I’ll give you half that, that’s all.”

The comments come as the market indeed has had to reprice its expectations for monetary policy. Where futures traders earlier in the year had been assigning a high probability to an aggressive series of interest rate cuts starting in March, they now see the easing not starting until June or July, with three cuts now priced in — half of the prior expectations.

Along with the elevated rates, markets have had to contend with the Federal Reserve rolling off its bond holdings, a process known as quantitative tightening. While the central bank is expected to start tapering the program soon, it remains another factor in tight monetary policy.

“It’s always a mistake to look at just the year,” Dimon said. “All these factors we talked about: QT, fiscal spending deficits, the geopolitics, those things may play out over multiple years. But they will play out and they will have an effect and in my mind I’m just kind of cautious about everything.”

However, Dimon said he doesn’t expect a replay of some of the other serious downturns the U.S. economy has faced, such as the 2008 financial crisis that saw Wall Street plunge as banks were hit with fallout from the subprime mortgage industry collapse.

Higher interest rates along with a recession could hit areas such as commercial real estate and regional banks hard, but with limited macroeconomic impacts, Dimon said.

“If we have a recession, yes, it’ll get worse. If we don’t have recession, I think most people will be able to muddle through this,” he said. “Part of this is just a normalization process. [Rates] were so low for so long. If rates go up, and we have recession, there will be real estate problems, and some banks will have a much bigger real estate problem than others.”

As far as regional banks go, he labeled issues that hit institutions such as Silicon Valley Bank and New York Community Bank as “idiosyncratic” and said private credit could take hit but not at a systemic level.

Don’t miss these stories from CNBC PRO:

Credit: Source link