JPMorgan Chase CEO Jamie Dimon isn’t worried about the added competition from a bulked-up Capital One if its $35.3 billion takeover of Discover Financial gets approved.

“My view is, let them compete,” Dimon said. “Let them try, and if we think it’s unfair, we’ll complain about that.”

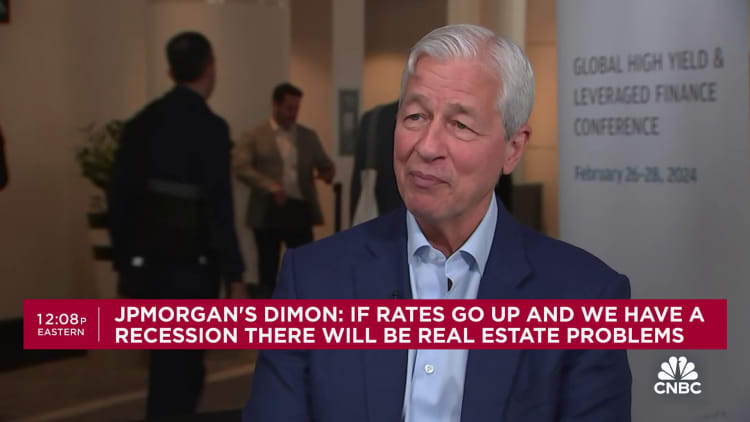

Dimon, speaking to CNBC’s Leslie Picker at a Miami conference, acknowledged that if regulators approve the Capital One-Discover deal, his bank will be eclipsed as the nation’s biggest credit card lender.

But that didn’t stop him from praising Capital One CEO Richard Fairbank, who he credited with shaking up the card industry in a way that ultimately led Dimon to becoming CEO of a predecessor firm to JPMorgan more than 20 years ago.

“Richard is why I’m here,” Dimon said.

About the transaction, he added, “I’m not worried about it really, but we do track everything he does.”

Last week, Capital One announced the biggest proposed merger of the year, one that could transform the trillion-dollar credit card industry. By acquiring Discover, Fairbank is both bulking up as a lender and boosting the smallest of the payments networks after Visa, Mastercard and American Express.

“The credit card business … they’ll be bigger and [have] more scale,” Dimon said. “They’re very good at it. I have enormous respect for Richard Fairbank and Capital One.”

It’s unclear if Capital One can create a true alternative to the dominant card networks with this deal, Dimon said.

He added that Capital One will have an “unfair advantage versus us” in debit payments, owing to the fact that legislation known as the Durbin Amendment caps debit fees for large banks, but not Discover or American Express.

“Of course, I have a problem with that,” Dimon said. “You know, like why should they be allowed to price debit different than we price debit just because of a law that was passed?”

More broadly, Dimon said he also favored allowing small banks to merge. A wave of industry consolidation has been expected after the tumult of last year’s regional banking crisis, but only a trickle of smaller deals have happened so far as executives are unsure if they can pass regulatory muster.

The biggest question remaining about the Capital One deal is whether regulators will approve it. More than a dozen Democrat lawmakers including Sen. Elizabeth Warren, D-Mass., signed a letter to the Federal Reserve and the Office of the Comptroller of the Currency on Sunday urging them to block the agreement.

“To protect consumers and financial stability, we urge you to block this merger and strengthen your proposed policy statement to prevent harmful deals in the future,” they wrote.

Don’t miss these stories from CNBC PRO:

Credit: Source link