Skyline of Tokyo, Japan.

Jackyenjoyphotography | Moment | Getty Images

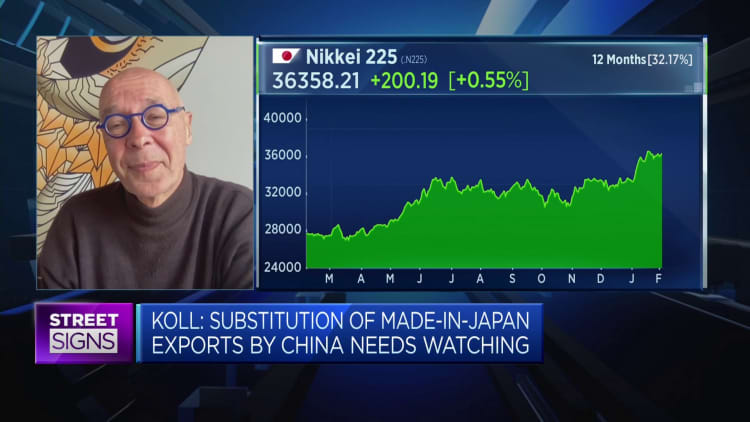

Japan’s Nikkei 225 smashed through the 40,000 level on Monday, soaring past another milestone to a new record high — but it did not surprise Japan expert Jesper Koll who expects another 37% upside for the benchmark stock index.

“In my view, it is perfectly reasonable to expect a rise in the Nikkei to 55,000 by end-2025. I [know I sound] more like a bubble-era stockbroker than a gentleman, but I cannot hide my excitement,” Koll, expert director at financial services firm Monex Group, told CNBC on Monday.

Koll was referring to the asset and equity bubble Japan saw in the late 80s, which resulted in the Nikkei hitting its 1989 highs.

But the euphoria did not last. In 1990, the bubble burst and Japan fell into a period of economic stagnation, known today as its “lost decades.” In less than a year, the Nikkei lost half its value.

Nikkei’s new highs

For the past two weeks, Japan’s benchmark stock index has been testing uncharted territory.

On Feb. 22, the index surpassed its previous all-time high of 38,915.87, set on Dec. 29, 1989 — breaching a record that was held for 34 years.

Following that, the index climbed past the 39,000 mark, and eventually crossed the 40,000 level on Monday.

In July last year, Koll told CNBC’s “Street Signs Asia” he expected the Nikkei to hit 40,000 “over the next 12 months.”

When asked what drives his optimism, Koll told CNBC on Monday that it was in part due to Japan’s ability to be a “capital value-creating superpower.”

He said his optimism does not stem from the Bank of Japan’s monetary actions, nor a boost from the so-called “new capitalism” initiative announced by Prime Minister Fumio Kishida in June.

Instead, his optimism comes from Japan’s private sector.

“Japan’s strength comes bottom-up from the private sector,” Koll said.

“Japan’s companies command superior earnings power. Two decades of relentless ‘kaizen’ restructuring have turned corporate Japan into a capital value-creating superpower.”

There is no question that Japanese ‘salarymen CEOs’ created more fundamental economic value than Wall Street’s superstar CEOs.

Jesper Koll

Expert director, Monex Group

“Kaizen” refers broadly to the art of constant improvement through small changes. First adopted by Japanese businesses after World War II, it is a Japanese term that seeks “continuous improvement.”

Notably, it views improvement in productivity as a “gradual and methodical process,” recognizing that improvement can come from any employee at any time.

“The days of almost desperate top-down crisis management and macro stimulus are over,” Koll said. “That was the fake rallies we got over the past 30 years.”

Koll said that between 1995 and 2022, the top-line sales growth for Topix companies was up by 1.1 times; but earnings per share rose by 11 times.

He compared it to the S&P 500 companies on Wall Street, pointing out those companies reported a sale growth of 3 times, and EPS rose by 6 times.

“There is no question that Japanese ‘salarymen CEOs’ created more fundamental economic value than Wall Street’s superstar CEOs.”

‘Go-go Nikkei’

Koll’s optimism does not end here. He said it is “perfectly reasonable” to expect the Nikkei to rise to 55,000 before the end of 2025.

“Go-go Nikkei,” he quipped, making a pun on the Japanese translation of 5-5 being “go-go.”

He said Japanese CEOs are the “undisputed global champions of delivering on the hard part, true economic value creation.”

Veteran value investor Warren Buffett increased his stakes in five of Japan’s largest trading houses in 2023, but promised the CEO of each company that Berkshire Hathaway “would never buy more than 9.9% without their consent.”

“They all welcomed us in, and their results have exceeded our expectations since we purchased the group,” he told CNBC in April last year.

“We couldn’t feel better about the investment [in Japan],” he added, after speaking to the CEOs of those trading houses, namely Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo.

According to Koll, the real question investors have to ask now is: What is the probability for Japanese profits and EPS to rise by 37% between now and end-2025?

He said that most foreign investors he spoke to think an EPS growth of about 30-40% is a “perfectly reasonable forecast.” He pointed out that after all, EPS surged 11 times between 1995 to 2002, during a time when Japan was experiencing deflation.

Potential headwinds

Still, there are may be global and domestic risks that could derail that optimism.

At home, Koll said Kishida is aiming to boost government spending, including raising child-care allowances and increased spending on deep tech university research and defense — but the prime minister has yet to present plans on how to pay for these initiatives.

As such, Koll is expecting tax hikes to be on the horizon, perhaps in 2025 or 2026. Historically, he said, tax increments have always been a big challenge for Japanese stocks.

The risk on the global front is what the Japan expert calls a “Made-in-China currency war.” If Chinese authorities are forced to devalue the Chinese yuan by about 20% to 30%, it would pose a huge challenge to Japanese competitiveness, he added.

Explaining his view, Koll said China might seek to weaken its currency in order to boost competitiveness if the country falls into outright deflation.

Another potential headwind could be U.S. or European tariffs imposed on Chinese imports.

“In a global trade war, Japan gets hurt,” Koll pointed out.

Credit: Source link