Bridgewater Associates founder Ray Dalio, speaking to Fortune‘s Kamal Ahmed at the World Economic Forum in Davos, Switzerland, issued a stark warning to global leaders and business executives: Stop pretending the old rules still apply. In a candid assessment of the current geopolitical landscape, Dalio argued the fate of the post-World War II global order—much debated amid President Donald Trump’s pursuit of Greenland and unsettling of the NATO alliance—is a moot point.

“Let’s not be naive and say, ‘Oh, we’re breaking the rule-based system,’” Dalio said. “It’s gone.”

The billionaire founder of the largest hedge fund in history added that as a student of financial history, he pays close attention to the economic cycles of the last 500 years and sees cycles repeat themselves over time.

“And what I learned through that exercise is the same thing happens over and over again,” he said. “And it’s like a movie for me. It’s like watching the same movie happen.”

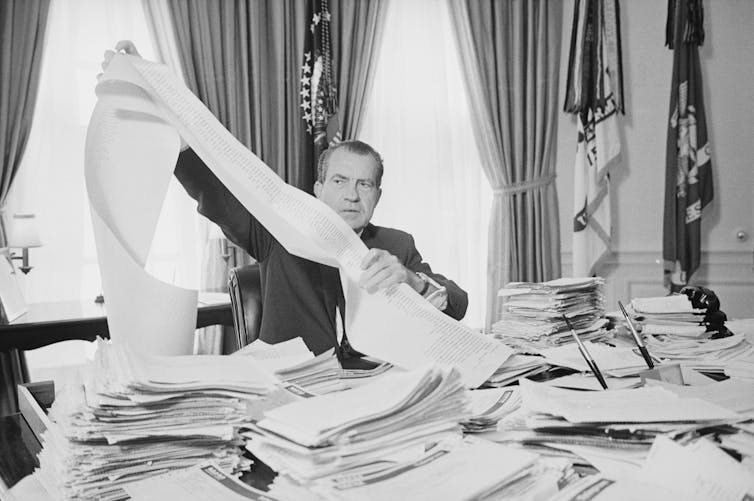

According to Dalio, five specific forces interact to drive the movie plot forward, with the “money-debt cycle” serving as the MacGuffin that kicks things off. The roots of the current instability, Dalio explained, lie in the monetary decisions made during the past several decades. Since 1971, when the U.S. under President Richard Nixon broke the dollar’s link to gold, Dalio notes, governments have consistently chosen to “print money” rather than allow debt crises to naturally play out. This behavior occurs when debt-service payments rise faster than incomes, squeezing spending. After more than half a century of this, he argued, repeating a consistent warning in his public remarks on the subject, the world is now witnessing a “breakdown of the monetary order,” evidenced by central banks altering their reserves and buying gold.

The previous day, Dalio had said in an appearance on CNBC’s “Squawk Box,” from the sidelines of the annual meeting in Davos, fiat currencies and debt as a storehouse of wealth were “not being held by central banks in the same way” anymore. He pointed to a decoupling in which the U.S. markets have underperformed foreign markets in specific metrics, a trend visible in the changing balance sheets of global central banks.

The core of Dalio’s concern lies in the transition from trade disputes to what he terms “capital wars.” He alluded to how U.S. Treasury bonds were the bedrock of global reserves for decades, but now, Dalio said the sheer supply of debt being produced by the U.S. is colliding with a shrinking global appetite to hold it.

“There’s a supply-demand issue,” Dalio noted, adding “you can’t ignore the possibility that … maybe there’s not the same inclination to buy U.S. debt.”

This reluctance is driven by geopolitical friction. According to Dalio, in times of international conflict, “even allies do not want to hold each other’s debt,” preferring instead to move capital into hard currencies. This shift forces the issuer of the debt to monetize it, a phenomenon Dalio summarized bluntly: “We’re increasingly buying our own money. That’s… the lesson of all this.”

As Dalio was speaking on Monday, markets weathered a global selloff as they digested the revelation that President Donald Trump was demanding U.S. possession of Greenland in revenge for not getting the Nobel Peace Prize in 2025. He had texted the Prime Minister of Norway Jonas Gahr Støre in anger about this, according to confirmed reports over the weekend, even though the Nobel Prize committee is separately operated from the government of Norway. But Dalio’s Tuesday remarks came amid calmer markets, as Trump reiterated his request for Greenland but clarified he would not authorize use of force to acquire it.

This economic instability feeds directly into the collapse of political norms, Dalio told Fortune on Wednesday. He argued the multilateral world order established in 1945—characterized by institutions such as the United Nations and the World Trade Organization—was arguably a “naive system” from the start, as it relied on representation without guaranteed enforcement.

“What happens when the leading power doesn’t want to abide by the vote?” Dalio asked. “Do you really expect that there’s going to be a United Nations vote or a World Court that’s going to resolve these things?”

The result, he argued, is a definitive shift from a multilateral system to a unilateral one. Dalio posited the central question of our time has become: “Who makes the rules, who enforces the rules, and how are you going to deal with that?”

Perhaps the most chilling aspect of Dalio’s analysis is the erosion of legal authority in favor of brute force. “Power matters more” than the law, he told Fortune, noting conflicts are increasingly decided by who controls the military, the police, and the National Guard. This trend is visible not only internationally but within nations, where democracy is threatened by populism and a growing belief the system is corrupt.

When asked if this rupture should strike fear into corporate boards and CEOs who have long relied on stable global rules, Dalio responded ignoring the truth is far more dangerous.

“I think what always scares me is the lack of realism,” he said.

Dalio advised leaders to stop relying on a dissolving rule-based system and instead focus on “jurisdiction questions,” seeking out places where people are “like-minded” and mutually supportive. Whether dealing with international boundaries or domestic regulations, Dalio insists businesses must now face the hard reality the era of assured legal protection is ending.

“Will law prevail?” Dalio asked. “Internationally, everybody is having to deal with that question.”

As confidence in institutions, the law itself, and fiat-denominated debt erodes, Dalio highlighted to CNBC the quiet but significant resurgence of gold. He emphasized gold should not be viewed merely as a speculative asset but as “the second-largest reserve currency” in the world. He noted in the previous year, gold was the “biggest market to move,” and it performed far better than tech stocks as central banks diversified their holdings. JPMorgan CEO Jamie Dimon had similar remarks in an interview with Fortune at the Most Powerful Women conference in October, when he said for the first time in his life, it had become “semi-rational” to have gold in your portfolio.

However, Dalio’s outlook was not entirely defensive. He said he sees the current era as a bifurcation between the decaying monetary order and a “wonderful technological revolution,” echoing Trump’s remarks onstage earlier that day about the “economic miracle” taking place. In that regard, at least, might may end up making right.

This story was originally featured on Fortune.com

Credit: Source link