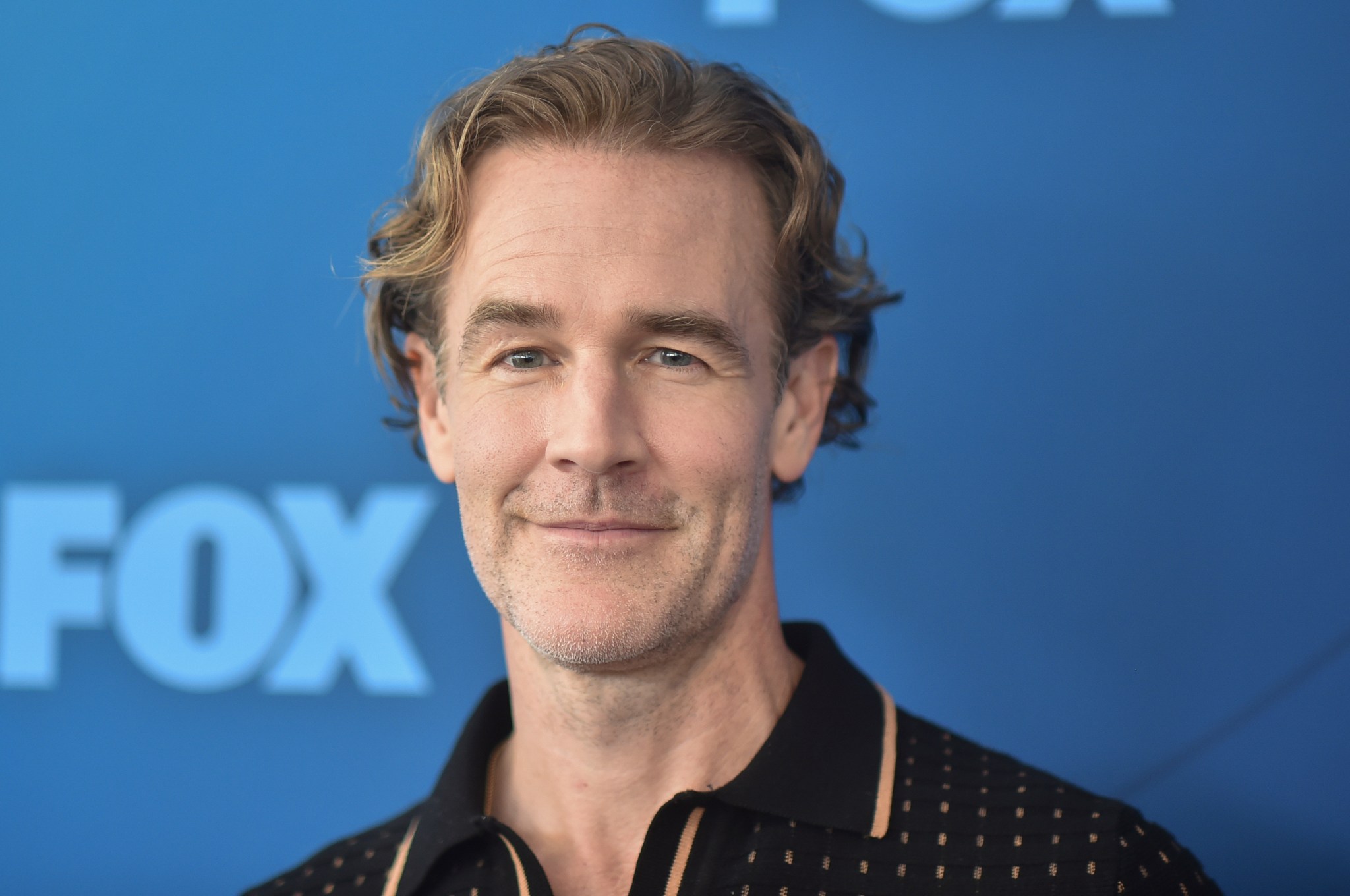

Mike Doustdar, CEO of Novo Nordisk, speaks in the Oval Office during an event about weight loss drugs at the White House, Nov. 6, 2025.

Andrew Caballero-Reynolds | Afp | Getty Images

Novo Nordisk entered 2026 with the momentum of a historic year in more ways than one — but recent weeks have delivered more drama than most companies might expect over a decade.

The Danish drugmaker kicked off the year with the explosive launch of the first-ever GLP-1 pill for obesity. Its recent challenges have centered around protecting its market share in the blockbuster weight loss drug market, all while its stock price swings wildly.

This week, Novo sued upstart telehealth provider Hims & Hers for alleged patent infringement and received its own warning from the Food and Drug Administration for what the agency says is misleading claims in advertising. That all followed a 2026 outlook that disappointed investors and stood in stark contrast to its chief rival, Eli Lilly.

While Lilly guided to 2026 sales growth of 25%, Novo forecast that sales and profits could decline as much as 13% this year.

“Enough has occurred in the past week to occupy a few volumes,” said Deutsche Bank analyst Emmanuel Papadakis on Tuesday, as he — like many of his Wall Street peers — lowered his price target on the stock following the gloomy outlook.

The rapid news flow has given investors whiplash. So far this calendar year, U.S.-listed Novo shares have traded across a spread ranging from $43.24 to $64.16, shedding as much as 14% in a single day only to gain 10% back in a later session.

Novo Nordisk U.S.-listed shares over the last month.

The latest developments add to a thorny situation for Novo as it risks being edged out by Lilly and cheaper compounded versions of semaglutide, which are unapproved copycats of Novo’s Wegovy jab.

CEO Mike Doustdar, who took the reins in August after the former CEO was ousted over misjudging the U.S. market and challenges there, has a plan to steer the company through what’s been described as a “show me” year.

His agenda is extensive: cracking down on those compounded knockoffs, sustaining strong demand for its newly launched obesity pill, building prescription volumes in the U.S. and bringing new next-generation obesity and diabetes treatments to market.

In an interview with CNBC on Wednesday, Doustdar acknowledged the challenges ahead but said 2026 “is also a year of growth in many ways.”

“We will have more patients this year than ever before, we will produce more than last year and years before that,” he said.

Doustdar said around 246,000 patients are currently on the company’s Wegovy pill, which launched at the beginning of January and is already outpacing the early rollouts of existing GLP-1 injections.

“This, of course, tells me that while the investors are feeling a bit of a headwind on the pricing side and the whole business as you’re alluding to, they are hopefully getting convinced that over a period of time that would wash out and that growth will come,” Doustdar said.

The compounding issue

Novo has repeatedly cited compounding pharmacies as a key reason for its slowing sales growth. The company estimates 1.5 million Americans are currently taking the copycat weight loss drugs offered by Hims & Hers, as well as some wellness clinics and compounding pharmacies.

Telehealth firms like Hims have profited massively from selling so-called compounded versions of injectable semaglutide under a regulatory loophole that allows other companies to sell copycats of the drugs if the branded medicines are in short supply. While branded semaglutide injections are no longer in short supply after a notable demand spike, the companies have continued to mass market cheaper versions directly to consumers, raising legal questions.

“We understand why compounding, mass compounding, got started. It was on the back of a shortage. We really don’t understand why it continued,” Doustdar told CNBC on Wednesday, noting that Novo’s opposition has nothing to do with medically necessary compounding for individual cases.

Hims last week announced plans to sell a compounded version of Novo’s newly launched Wegovy pill for roughly $100 less than Novo sells the branded version for, though it quickly backed down after Novo said it would sue over patent infringement and the FDA announced a broader crackdown on compounding. The agency also said it had referred Hims to the Department of Justice over potential violations.

The Hers website arranged on a laptop in New York, US, on Wednesday, Feb. 12, 2025.

Gabby Jones | Bloomberg | Getty Images

Novo moved to sue Hims on Monday over compounded versions of both injectable and oral semaglutide, adding to more than 130 lawsuits the drugmaker has filed against pharmacies, wellness clinics and other firms unlawfully marketing those copycats.

“The news last Thursday about the pill… was seen as kind of the last straw for many people,” Rothschild & Co Redburn analyst Simon Baker told CNBC.

From the point of view of U.S. regulators, removing cheaper drugs from the market at a time when the Trump administration has made lower drug prices for Americans a priority might not have been an easy sell, Baker said.

But, “when we got the move on the pill, there was a realization that this has just gone a little bit too far,” he added. “You can’t have people launching knock-off versions of pills five weeks after the brand gets launched.”

“That would destroy the industry.”

If Novo can get the compounding issue under control, the company can potentially win back some market share and turn things around for sales projections, said BMO Capital Markets analyst Evan Seigerman.

Doustdar called it “a very strong signal” that the government acknowledged the compounding fight with Hims and “articulated that very publicly. We welcome that.”

Of course, a government crackdown on compounding wouldn’t clear the way for Novo alone.

Lilly’s obesity drug Zepbound already enjoys significant market share, and the company is preparing to launch its own oral version.

The market share race

A combination image shows an injection pen of Zepbound, Eli Lilly’s weight loss drug, and boxes of Wegovy, made by Novo Nordisk.

Hollie Adams | Reuters

The battle for U.S. market share could amount to a must-win for Novo — the weight loss segment accounted for more than half of its sales in 2025.

Lilly is estimated to have around 60% of the branded GLP-1 market globally, while Novo has about 39%. Novo has also highlighted a gap in the “preference share” for Wegovy versus Lilly’s injections.

Lilly’s obesity drug Zepbound has shown more pronounced weight loss than Wegovy and has become the preferred medicine among patients and prescribers, despite launching years after Novo’s drugs.

In the U.S., Novo estimates that between 7 and 8 patients out of 10 go to Lilly.

Meanwhile, in the compounding market, the share of copycats for Novo’s drug far outweighs that of Lilly’s.

“It’s a curious question as to why in the branded market, Lilly has a much bigger share than Novo but in the compounded market, there’s a lot more of Novo’s molecule than there’s of Lilly’s,” Baker noted. “We don’t know the answer.”

Novo is banking on the Wegovy pill to help with its eroding market share and says it’s already reaching entirely new patients. Doustdar has said that 88% of people on the pill are taking the lowest starter dose of the drug, signaling that many patients have been waiting on oral options.

Lilly is expected to launch its rival weight loss pill, orforglipron, in the second quarter of 2026. Investors are closely watching how that will pan out, especially as Novo has lost its first-mover advantage before.

“They’re putting a lot of muscle behind the marketing of [Wegovy pill], including now a reinvigorated direct-to-consumer channel, which they were a little bit late to arrive at,” TD Cowen analyst Michael Nedelcovych told CNBC. “That seems to be paying dividends.”

Still life of the new Wegovy semaglutide tablets on a white background. Its a prescription medicine used with a reduced calorie diet and .and physical activity.

Michael Siluk | Universal Images Group | Getty Images

Doustdar touted the pill’s efficacy, which is on par with the Wegovy injection and superior to Lilly’s oral drug based on separate clinical trials. The Wegovy pill showed around 16.6% weight loss on average compared to roughly 12.4% on average with Lilly’s oral drug.

“If you use these two numbers, basically you have a 40% difference between the efficacy of these pills,” he said. “I think this is going to be a very main, main selling point of the pill.”

When Lilly eventually launches orforglipron, its primary marketing point will likely be aimed at convincing customers that the Wegovy pill is inconvenient because of certain food restrictions. That makes Novo’s head start extra important as it offers them a chance to lay the groundwork and convince people of the contrary.

Novo contends that those dietary requirements won’t hinder uptake. But Leerink Partners analyst David Risinger told CNBC last week that it could help Lilly’s pill eventually generate greater sales globally.

Still, while sales of both companies’ drugs may soar, prices are coming down across the board.

U.S. pricing headwinds

The GLP-1 market is facing broad price erosion following landmark “most favored nation” deals between companies and the Trump administration. It’s unclear how much of the price decline can be offset by volume increases.

“No matter how well we do initially to catch up with the price decrease … of course mathematically, [it] takes a bit of time,” Doustdar said, adding the company is “very hopeful” and “working day and night to accelerate those volume uptakes.”

Analysts largely believe Novo is being intentionally cautious with its sales projections, baking in the expected pricing pressures.

“There are a number of pushes and pulls in 2026, some have quite high visibility, some have lower visibility… I think Novo have added in the things of high visibility more than the things of low visibility,” said Baker.

Where there’s higher visibility is where pricing is coming down, generics in Canada and a few other markets, and restrictions on Medicaid for some of their drugs, Baker said: “They’ve got these negatives in quite fully.”

“Given the problems they had last year, they don’t want to overpromise and underdeliver,” he said.

Novo’s guidance likely doesn’t include any reduction in the volume of compounded drugs on the market, as the FDA’s announcement of its “decisive steps” to restrict GLP-1 compounding came after the guidance was released.

But the price sensitivity of consumers for weight loss drugs remains a big unknown, which makes greater volumes and more access points important.

Novo is anticipating Medicare coverage for weight loss treatments, expected to begin later this year, to open up a 15 million-patient opportunity, Doustdar told CNBC.

Around 67 million Americans are covered by Medicare, but “when you take a look at specifically our products and the target group, I think around 15 million people would be a good number to target,” Doustdar said. Though he said Medicare access to obesity treatments will open up gradually.

Next-generation treatments

Flags with the logo of Novo Nordisk flutter next to the company’s factory in Hillerod on Nov. 12, 2025.

Sergei Gapon | AFP | Getty Images

Novo is also pinning its hopes on other drugs in its pipeline to help it claw back market share. That includes a higher dose – 7.2 milligrams – of Wegovy, which is waiting for FDA approval and could make the drug a stronger competitor to Zepbound.

Doustdar said that higher dose helps patients lose around 21% of their weight, which is “very much on par” with the highest dose of Zepbound. Wegovy, under its approved doses, has shown around 15% weight loss on average in clinical trials.

“When that comes to the market, my thought, my wish, my hope is that people will realize, OK, now we have two products with similar efficacy,” Doustdar said.

He added that “hopefully will also change the dynamic as we go forward,” referring to the market’s increasing preference for Zepbound.

BMO’s Seigerman said it’s difficult to say whether that will be the case, as Zepbound is already entrenched as the best product in the injectable market.

Later this year, Novo expects its next-generation treatment called CagriSema to enter the market. That experimental weekly injection combines semaglutide with cagrilintide, which mimics another gut hormone called amylin.

Novo Nordisk has defended CagriSema’s trial results, which disappointed investors, coming in under the expected 25% weight loss on average.

On Wednesday, Doustdar said the company was “penalized quite harshly by the stock market” for those results, which showed around 23% weight loss. But he said the drug would be “one of the best products out there” if it were available today.

To assess the real efficacy of the drug, “you need to look at all the data together,” he added, pointing to three upcoming phase three trials for the drug, including one study that pits CagriSema against Zepbound.

When asked whether Novo needs to further diversify away from obesity like competitors, Doustdar argued that the company doesn’t see obesity or diabetes as a single, monolithic disease and sees more opportunity in developing multiple, specialized therapies within the category.

While the world labels millions of patients simply as “obese,” he said the underlying biology and severity of the condition vary widely – from someone who needs to lose a modest amount of weight to someone with severe complications like fatty liver disease requiring a transplant.

And as the market matures, Novo’s sales are still growing year-on-year on a constant currency basis, albeit at a slower pace than before. Only time will tell when, or if, that will change.

Correction: This story has been revised to reflect that Novo Nordisk shares have traded in the range of $43.24 to $64.16 this calendar year. A previous version misstated the time range of the trading spread.

Credit: Source link