Global healthcare investment firm OrbiMed announced it raised more than $4.3 billion in commitments for its private investment funds–OrbiMed Asia Partners V, OrbiMed Royalty & Credit Opportunities IV and OrbiMed Private Investments IX.

A range of university endowments, pension funds, medical institutions, foundations, family offices and sovereign wealth funds invested in the funds.

WHAT THEY DO

OrbiMed invests in businesses from the seed stage to large publicly-traded companies in biopharmaceuticals, medical devices, diagnostics and technology-enabled healthcare services.

Its portfolio consists of fertility benefits manager Carrot Fertility, chronic condition management platform DarioHealth, tech-enabled drug discovery startup Insilico, health data company MDClone, AI-powered preclinical drug discovery platform TandemAI and virtual primary care company TytoCare.

OrbiMed will use the funds to invest in seed-stage startups through growth capital opportunities.

“OrbiMed is deeply appreciative of the continued support we’ve received from many long-standing partners who’ve invested in these funds,” Carter Neild, a managing partner of OrbiMed, said in a statement. “We will endeavor to meet our partners’ high expectations in the coming years.”

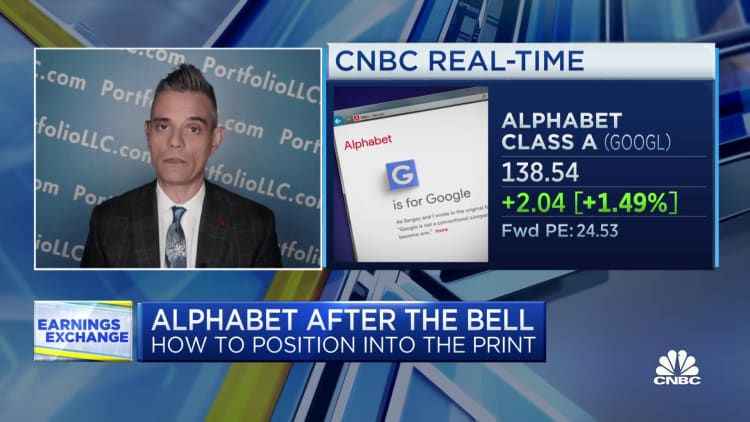

MARKET SNAPSHOT

Several investment firms have announced capital raises in the past few months.

Private investment firm 1315 Capital, which provides growth capital to commercial-stage health and wellness as well as pharmaceutical and medical technology companies, announced yesterday it closed two funds totaling more than $500 million.

Last month, Rev1 Ventures announced its third research-focused fund, Catalyst Fund II, which will see $30 million invested in growing life sciences startups in the central Ohio region.

Rev1’s vice president of investment funds, Ryan Helon, joined HIMSS TV to discuss the fund in detail earlier this month.

Credit: Source link