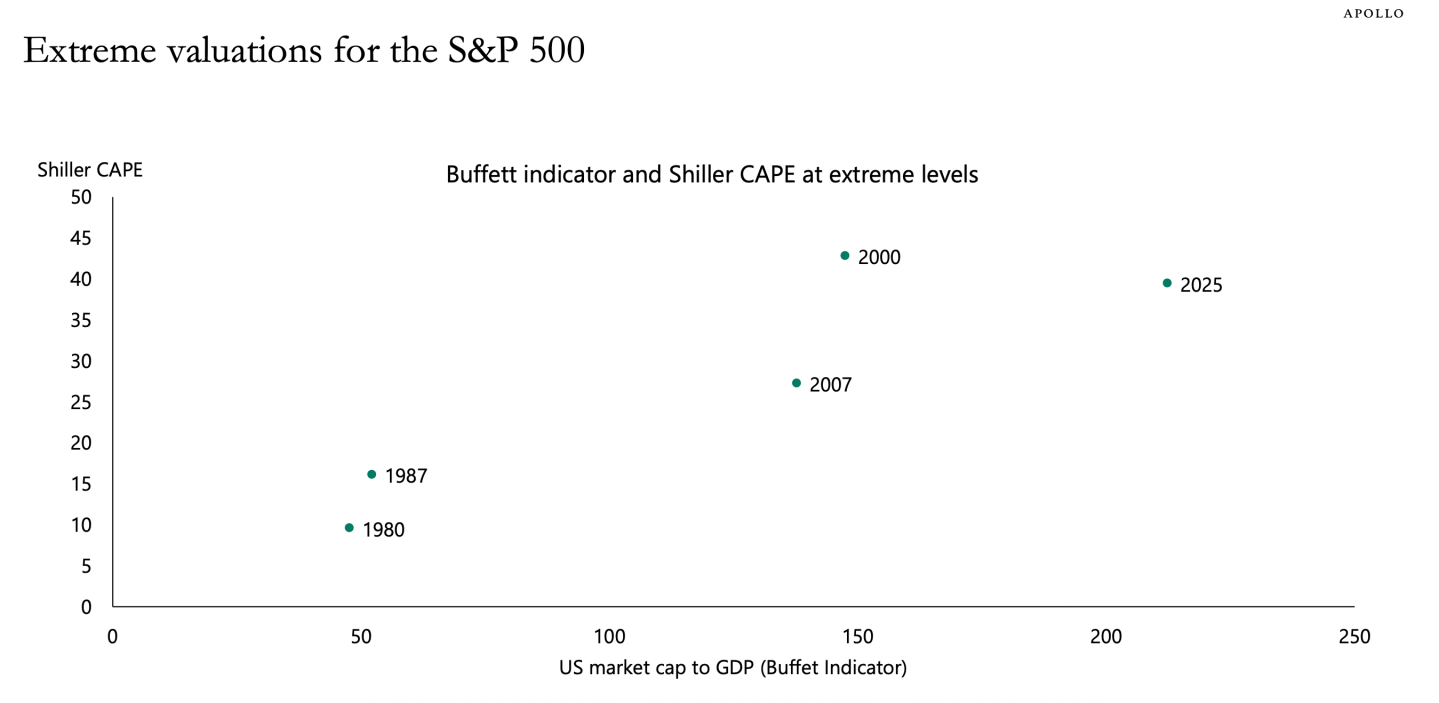

Analysts might argue you can’t have a bubble without a burst. With markets nearing correction territory, some investors might be wondering if the time to sell is nigh—but hedge fund founder Ray Dalio believes there’s no need to panic just yet.

The founder of Bridgewater Associates agrees with the general consensus that stocks are in some form of a bubble right now, arguing there are vulnerabilities in the economy. But that doesn’t mean it’s time to exit the play, he added.

“Don’t sell just because there’s a bubble,” Dalio said in an interview with CNBC aired yesterday. “But if you look at the correlations with the next 10 years’ returns, when you are in that territory, you get very low returns.”

Other prominent figures in the AI and markets space believe that even if the industry is in bubble territory, that’s not necessarily the end of the world. JPMorgan Chase CEO Jamie Dimon, for example, compared today’s AI exuberance to the early days of the internet, calling that “in total, a payoff,” as Google, YouTube, and Meta eventually emerged and proved durable. Speaking at Fortune’s Most Powerful Women conference in October, he said he was somewhat cautious about conditions in the current market, yet he urged people not to simply label all of AI as a speculative frenzy. “You can’t look at AI as a bubble, though some of these things may be in the bubble. In total, it’ll probably pay off.”

Indeed, even Alphabet CEO Sundar Pichai is realistic about frothy speculation, saying recently that while this is an “extraordinary moment” there is some “irrationality” in the AI boom. If such a bubble were to burst, he told the BBC: “I think no company is going to be immune, including us.”

76-year-old Dalio, who has a net worth of $15.4 billion per Forbes, is of the opinion that the bubble can burst, but will need stimulus to do so. “I think that you have to say it’s unsustainable,” he added. “Then you have to go to the timing—what is it that pricks the bubble?” There’s good news here: Typically it’s a tight monetary policy, but “we’re not going to have that now,” adds Dalio.

What may cause such a pop is when people who have generated wealth from the bubble decide they want the cash for themselves. “The need for cash is always that which pricks the bubble, because … you can’t spend wealth, you have to sell wealth in order to get to buy the things you need, or pay the bills you have,” Dalio added. “I think the picture is pretty clear in that we are in that territory of a bubble, we are in that bubble territory, but we don’t have the pricking of the bubble yet.”

Mindful of risks

Heading into 2026, UBS’s chief investment officer Mark Haefele warned investors that while the equity outlook remains positive, they should be mindful of over exposure to the risks surrounding AI.

As he wrote in his monthly house view note to clients yesterday, in the medium term AI has the potential to deliver the productivity improvements to help economies achieve a new era of growth. However, “much will depend on investors’ willingness to keep funding it, tech leaders’ ability to monetize it, and the world’s capacity to supply the energy needed to power it.”

He cautioned: “Strong capex and adoption should fuel further gains in 2026, though investors should be mindful of bubble risks.”

Credit: Source link