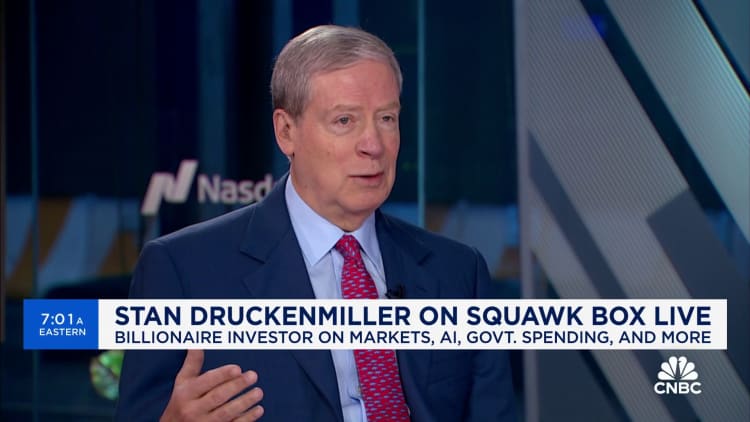

Billionaire investor Stanley Druckenmiller revealed Tuesday that he slashed his big bet in chipmaker Nvidia earlier this year, saying the swift artificial intelligence boom could be overdone in the short run.

“We did cut that and a lot of other positions in late March. I just need a break. We’ve had a hell of a run. A lot of what we recognized has become recognized by the marketplace now,” Druckenmiller said on CNBC’s “Squawk Box.”

Druckenmiller said he reduced the bet after “the stock went from $150 to $900.” “I’m not Warren Buffett — I don’t own things for 10 or 20 years. I wish I was Warren Buffett,” he added.

Nvidia has been the primary beneficiary of the recent technology industry obsession with large AI models, which are developed on the company’s pricey graphics processors for servers. The stock was one of the best performers last year, rallying a whopping 238%. Shares are up another 66% in 2024.

The notable investor, who now runs Duquesne Family Office, said he was introduced to Nvidia by his young partner in the fall of 2022, who believed that the excitement about blockchain was going to be far outweighed by AI.

“I didn’t even know how to spell it,” Druckenmiller said. “I bought it. Then a month later, ChatGPT happened. Even an old guy like me could figure out okay, what that meant, so I increased the position substantially.”

While Druckenmiller has cut his Nvidia position this year, he said he remains bullish in the long term on the power of AI.

“So AI might be a little overhyped now, but underhyped long term,” he said. “AI could rhyme with the Internet. As we go through all this capital spending, we need to do the payoff while it’s incrementally coming in by the day. The big payoff might be four to five years from now.”

The widely followed investor also owned Microsoft and Alphabet as AI plays over the past year.

Druckenmiller once managed George Soros’ Quantum Fund and shot to fame after helping make a $10 billion bet against the British pound in 1992. He later oversaw $12 billion as president of Duquesne Capital Management before closing his firm in 2010.

Credit: Source link