Death and taxes may be inevitable. A big bill for your heirs is not.

The rich have made an art of avoiding taxes and making sure their wealth passes down effortlessly to the next generation. But the tricks they use – to expedite payouts to heirs and avoid handing money to the government – can also work for people with far more modest estates.

“It’s a strategic game of chess played over decades,” says Mark Bosler, an estate planning attorney in Troy, Michigan, and legal adviser to Real Estate Bees. “While the average person relies on a simple will, the well-to-do utilize a different playbook.”

Consider a trust

First, consider the facts: Despite widespread misconceptions, only estates of the very richest Americans are generally subject to taxes. At the federal level, estates of over $15 million typically trigger taxes. At the state level, 16 states and the District of Columbia do collect estate or inheritance taxes, according to the Tax Foundation, sometimes with lower exemptions than the IRS, but still at thresholds targeting millionaires.

While most people can pass on what they have without worrying about their heirs being caught in a web of taxes, it can require planning to escape a messy process that can hold up estates for years and cost families significantly in court fees and lawyer bills.

The solution at the center of many estate planners’ designs is a trust.

Though trusts conjure images of complex arrangements utilized by the uber-rich, they are relatively simple tools that can make sense for many people. They come with expense, often costing thousands of dollars in lawyer fees to set them up. But for a retired couple with a paid-off house, 401(k)s and a portfolio of investments, they can ease the passing of assets to heirs.

Among the reasons: Even if you aren’t leaving enough behind to trigger taxes, your estate can get tied up in probate court, which typically assesses fees based on an estate’s total value.

“You are leaving what might have gone to your children or other loved ones to attorneys and the courts,” says Renee Fry, CEO of Gentreo, an online estate planner based in Quincy, Massachusetts. “Anywhere from 3 to 8% of an estate might be lost.”

Trusts can allow an estate to sidestep court altogether and to shield it from public view by keeping details out of public records. Some people also use them to protect their savings if they someday need nursing home care and would prefer to qualify for a government-paid stay under Medicaid instead of paying themselves.

Pass on stocks virtually tax-free

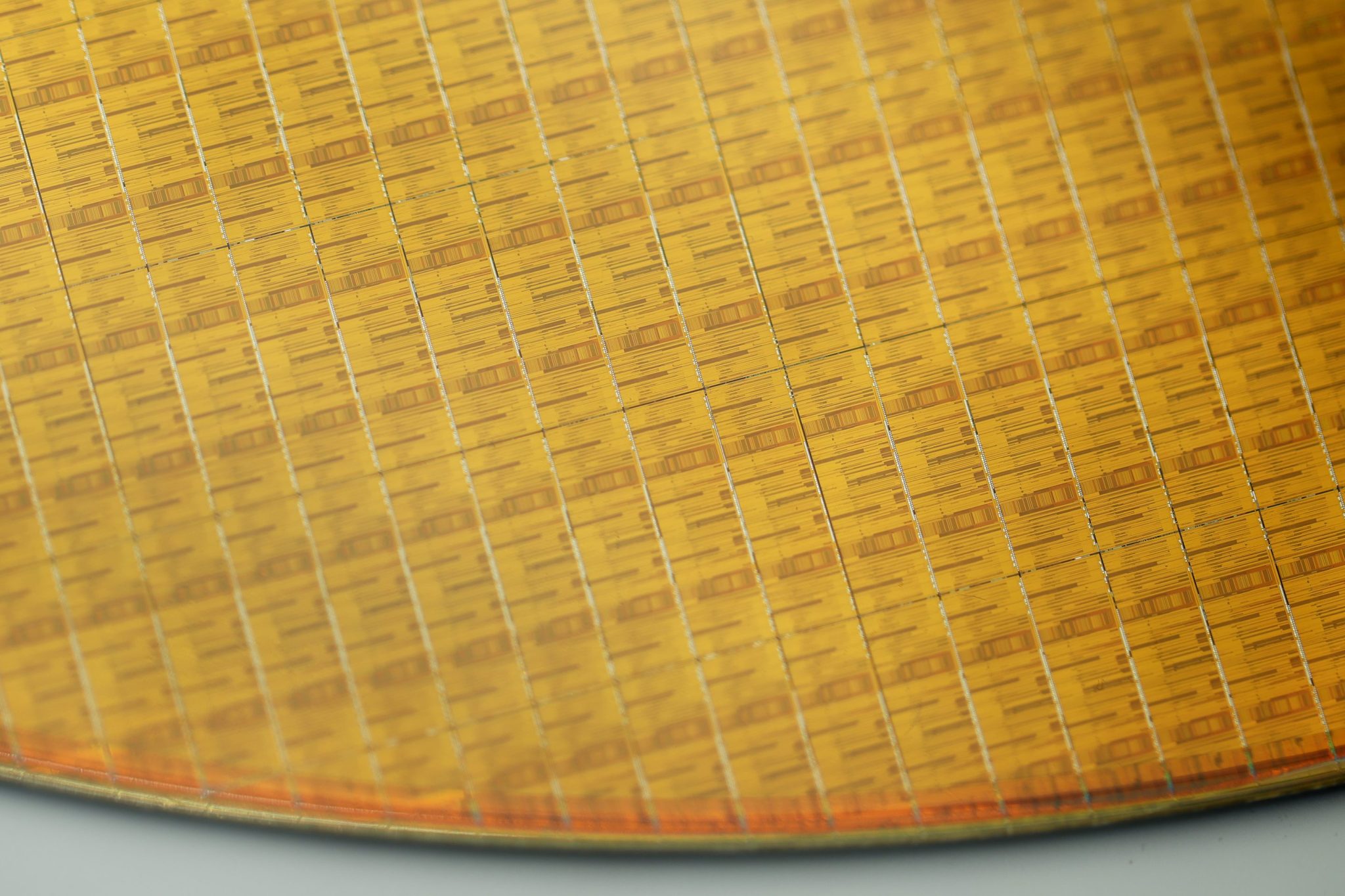

Imagine being an investor in a stock like Nvidia that has soared in recent years. Now imagine being able to reap the profit of selling your shares without paying tax.

It’s possible with one caveat: You have to die.

That scenario, known in estate lingo as “step-up,” allows many rich families to grow their wealth while ensuring their heirs won’t be saddled with the bill.

It works like this: Say your savvy uncle bought 100 shares of Nvidia when it began trading in 1999 at $12 a share. Between splits and a soaring price, that $1,200 investment would be worth more than $9 million today. If he left it all to you, you could sell the shares owing little or no tax because gains are calculated from the day he died, not the day he bought it.

Benjamin Trujillo, a partner with the wealth advisory firm Moneta, based in St. Louis, Missouri, says it all seems “like a magic trick.” And it’s completely legal.

“Wealth transfer looks like smoke and mirrors,” Trujillo says. “Assets like stocks can quietly grow for decades and, when they’re inherited, the tax bill often disappears.”

Lawmakers have sometimes proposed limits on the “step-up” rule but at least for now, it remains, making it one of the biggest not-so-secret weapons in the arsenals of those looking to create generational wealth. If stocks aren’t your forte, “step-up” applies to other types of investments too, including artwork, real estate and collectibles.

Keep up to date on beneficiaries

Ever get a prompt on one of your accounts asking you to name a beneficiary? It’s more than a confusing (or annoying) nudge from your brokerage. Estate planners say it is one of the simplest ways to ease the transfer of assets to loved ones after you die.

Regulations vary from place to place, but many banks and brokerages allow you to name a beneficiary to whom the funds will be transferred to upon your death.

“One of the easiest ways to transfer assets hassle-free,” says Allison Harrison, an attorney in Columbus, Ohio, who focuses on estate planning.

Beneficiary designations generally override wills, so it’s important to make sure yours are up to date to avoid the mess of having, say, an ex-spouse end up with everything you saved.

All of this requires planning, but experts say investing a little time in mapping out your estate is one of the moves that separates the rich from the less well-off.

“Wealthy families plan,” says Fry. “They don’t leave assets and decisions unprotected.”

Credit: Source link