Kate_sept2004 | E+ | Getty Images

Investing can seem overly complicated, and that complexity may paralyze Americans into doing nothing.

But investing — and doing so smartly — doesn’t have to be hard. In fact, getting started can be relatively easy, according to financial experts.

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ,” Warren Buffett, chair and CEO of Berkshire Hathaway, famously said.

For many people, investing is a necessity to grow one’s savings and provide financial security in retirement. Starting early in one’s career benefits the investor due to a longer time horizon for interest and investment returns to compound.

While appropriate long-term goals may differ from person to person, one rule of thumb is to save roughly 1x your salary by age 30, 3x by 40 and ultimately 10x by 67, according to Fidelity Investments.

A ‘fabulous, simple solution’ for beginners

Target-date funds, known as TDFs, are the simplest entry point to investing for the long term, according to financial pros.

“I think they’re a fabulous, simple solution for novice investors — and any investor,” said Christine Benz, director of personal finance and retirement planning at Morningstar.

TDFs are based on age: Investors choose a fund based on the year in which they aim to retire. For example, a current 25-year-old who expects to retire in roughly 40 years may pick a 2065 fund.

These mutual funds do most of the hard work for investors, like rebalancing, diversifying across many different stocks and bonds, and choosing a relatively appropriate level of risk.

Asset managers automatically throttle back risk as investors age by reducing the share of stocks in the TDF and raising the exposure to bonds and cash.

How to pick a target-date fund

TDFs are a good starting point for “do nothing” investors who seek a hands-off approach, said Lee Baker, a certified financial planner and founder of Apex Financial Services in Atlanta.

“That’s the easiest thing for a lot of people,” said Baker, a member of CNBC’s Advisor Council.

Investors need only choose their TDF provider, their target year and how much to invest.

Benz recommends selecting a TDF that uses underlying index funds. Index funds, unlike actively managed funds, aim to replicate broad stock and bond market returns, and are generally cheaper; index funds (also known as passive funds) tend to outperform their actively managed counterparts over the long term.

“You definitely want a passive TDF,” said Carolyn McClanahan, a CFP and the founder of Life Planning Partners in Jacksonville, Florida.

Benz also advises investors seek out funds from among the biggest TDF providers, like Fidelity, Vanguard Group, Charles Schwab, BlackRock or T. Rowe Price.

Other ‘solid choices’ for novice investors

Investors who want to be a bit more hands-on relative to TDF investors have other simple options, experts said.

Some may opt for a target-allocation fund, for example, Baker said. These funds are like TDFs in that asset managers diversify among stocks and bonds according to a particular asset allocation — say, 60% stocks and 40% bonds.

But this allocation is static: It doesn’t change over time as with TDFs, meaning investors may eventually need to revisit their choice. They can determine which fund might be a good starting point by filling out an online risk profile questionnaire, Baker said.

More from Personal Finance:

Why Social Security COLAs may be smaller in 2025 and beyond

‘Take the emotion out of investing’ during an election year

Why Social Security is so important for women

As another option, investors may instead opt for a global market index fund, an all-stock portfolio diversified across U.S. and non-U.S. equities, Benz said. As with target-allocation funds, these funds don’t de-risk as one ages.

“I think sometimes novice investors question the simple elegance of some of these very solid choices,” Benz said. “People crave something more complex because they assume it has to be better, but it’s not.”

Ask yourself: Why am I investing?

Young, long-term investors should generally ensure their fund — whether TDF or otherwise — has a high allocation to stocks, around 90% or more, said McClanahan, a member of CNBC’s Advisor Council.

Retirement investors under age 50 would likely be well-suited with a portfolio tilted mostly to stocks, with some cash reserves set aside in the event of emergencies like job loss or health issues, Benz said.

You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.

Warren Buffett

chair and CEO of Berkshire Hathaway

One caveat: Investors saving for a short- or intermediate-term need — maybe a house or car — would likely be better served putting allotted money in safer vehicles like money market accounts or certificates of deposit, McClanahan said.

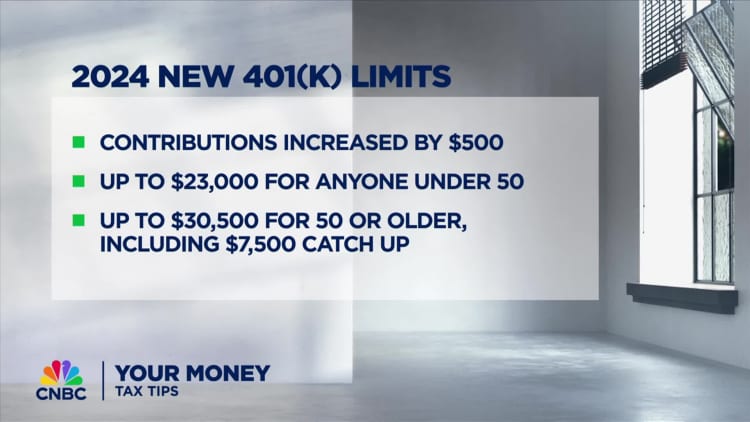

The easiest place for long-term investors to save is a workplace retirement plan like a 401(k) plan. Those with an employer match should aim to invest at least enough to get the full match, McClanahan said.

“Where else do you get 100% on your money?” she said.

Investors who don’t have access to a 401(k)-type plan can instead save in an individual retirement account — another type of tax-preferred retirement account — and set up automatic deposit, McClanahan said.

TDF investors who save in a taxable brokerage account may get hit with an unexpected tax bill, experts said. Because TDFs regularly rebalance, there are likely to be transactions within the fund that trigger capital-gains taxes if not held in a tax-advantaged retirement account.

Credit: Source link