Economic headlines have been grim recently. The jobs report from July shattered the narrative that the economy of 2025 was strong, revising previous figures downward and revealing something close to an 80% collapse in hiring, even as inflation crept upwards and layoffs rolled. August was another bad one, with just 22,000 jobs added. But what if that was the bottom of a secret, “rolling” recession in place for nearly three years, dating back to 2022? That’s what one of the top minds on Wall Street thinks.

Morgan Stanley’s Chief U.S. Equity Strategist Mike Wilson says the August report is actually more confirmation of his primary thesis that goes back several years. “Central to our view,” Wilson’s team wrote in a note published on the morning of September 8, “is the notion that the economy has been much weaker for many companies and consumers over the past 3 years than what the headline economic statistics like nominal GDP or employment suggest.”

In other words, amid the many predictions of a recession about to hit the U.S. economy or a revival of 1970s-style stagflation, Wilson has been banging the drum that the recession was already here, just in disguise. The good news is that if a recession was disguised, then the current, early-stage bull market has been, too: “Friday’s weak labor report provides further evidence of our thesis that we are now transitioning from a rolling recession to a rolling recovery. In short, we’re entering an early cycle environment and the Fed cutting rates will be key to the next leg of the new bull market that began in April.”

The ‘rolling recession’: What happened?

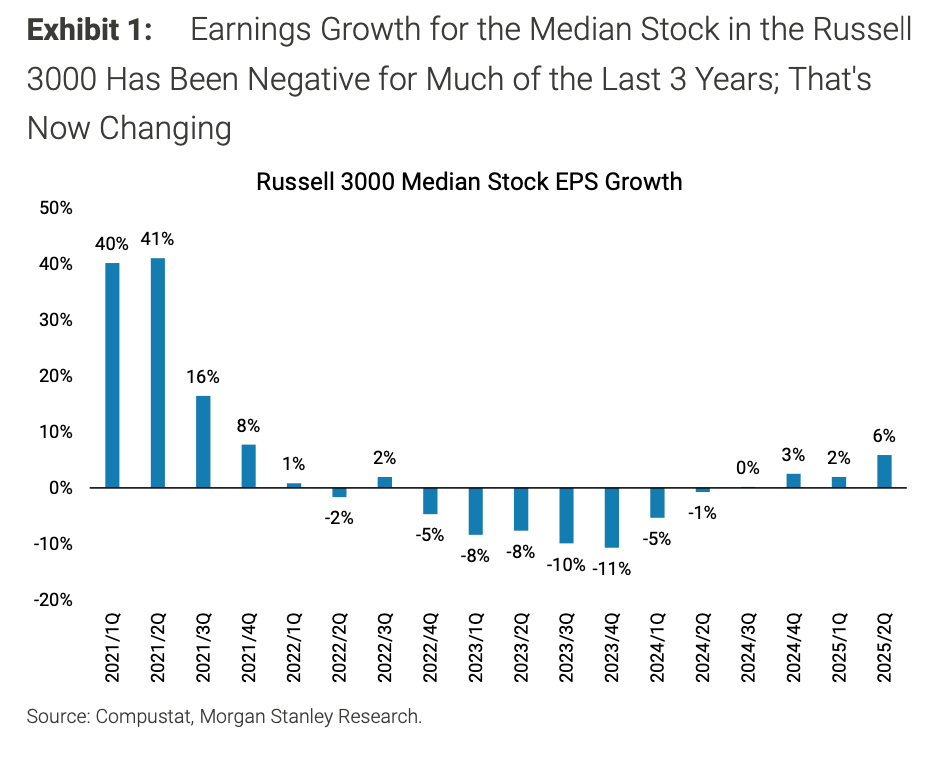

According to Wilson and his team at Morgan Stanley, the recession never materialized as a sudden collapse or sharp spike in unemployment. Instead, weakness moved sector-by-sector from pandemic winners like tech and consumer goods to the rest of the economy, with each industry suffering its own downturn at different times. This “rolling recession” meant the usual markers of broad economic pain—soaring unemployment, plummeting GDP—remained muted even as weakness mounted underneath the surface. “We saw most sectors of the economy go through their own individual recessions at different times,” the bank argued.

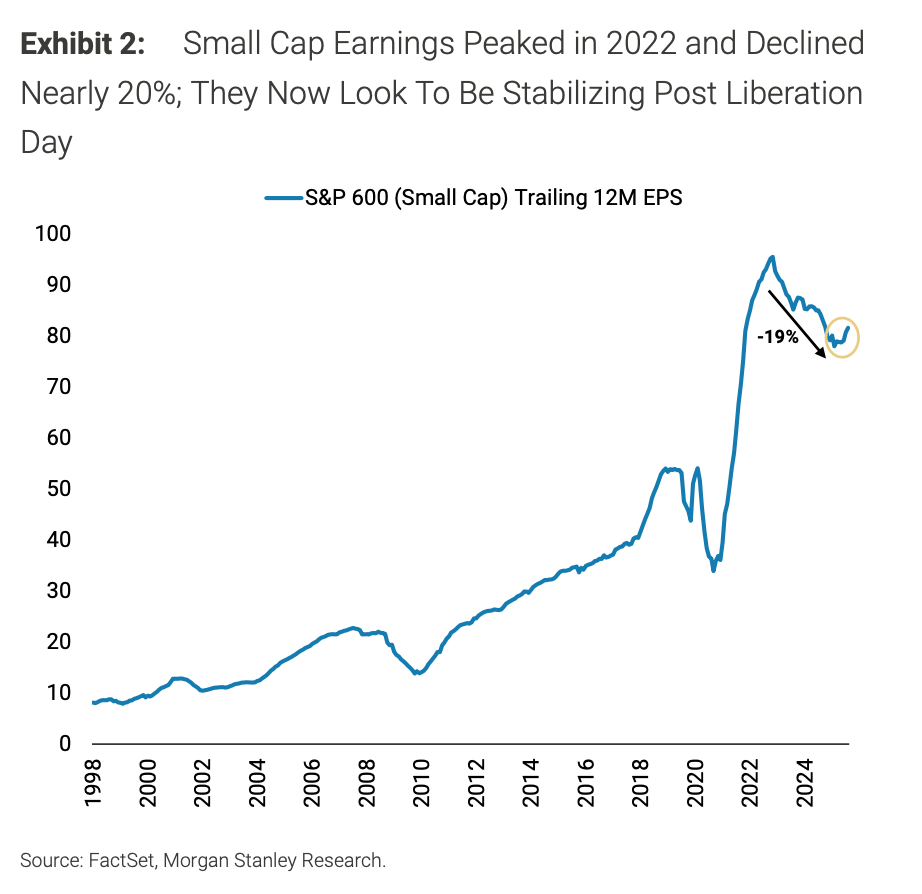

Several factors contributed to this slow-moving pain. Post-pandemic immigration surges, followed by stricter enforcement, distorted many traditional labor-market signals and clouded real-time interpretation of headline statistics. Median earnings growth for companies across the Russell 3000 index remained negative for much of three years—yet the overall stock market seemed to sidestep a crash, until recently.

Was Liberation Day the bottom?

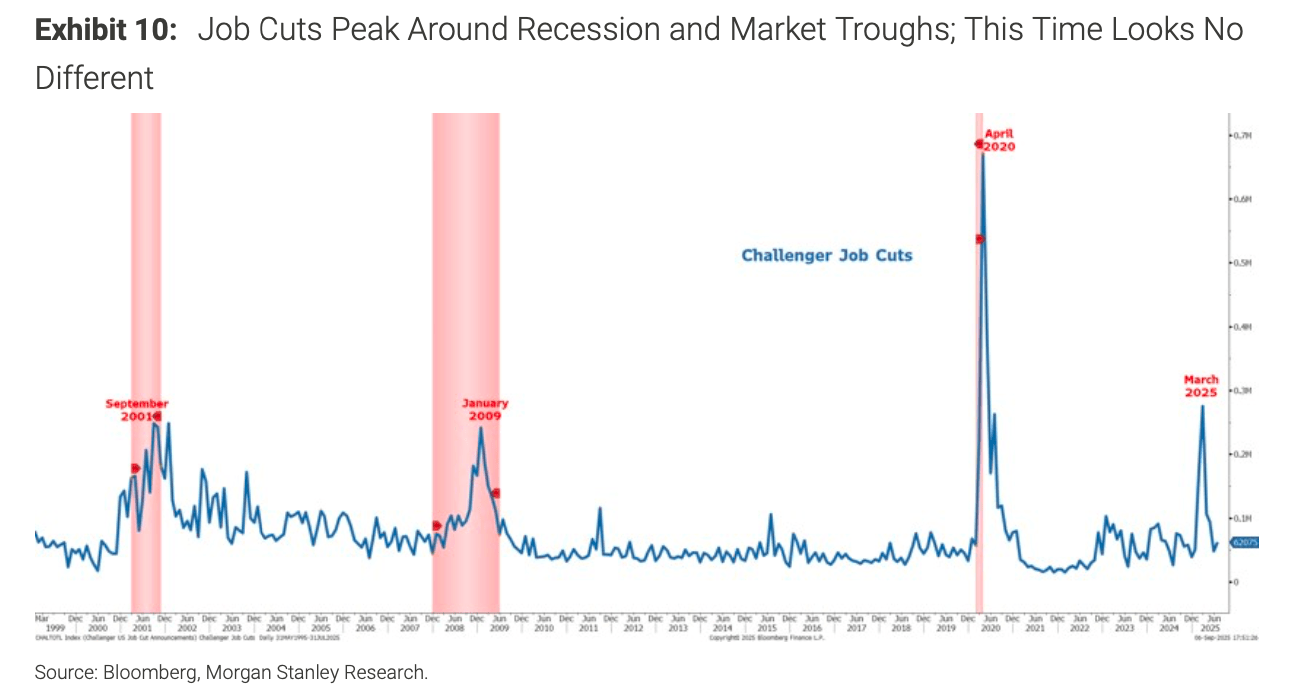

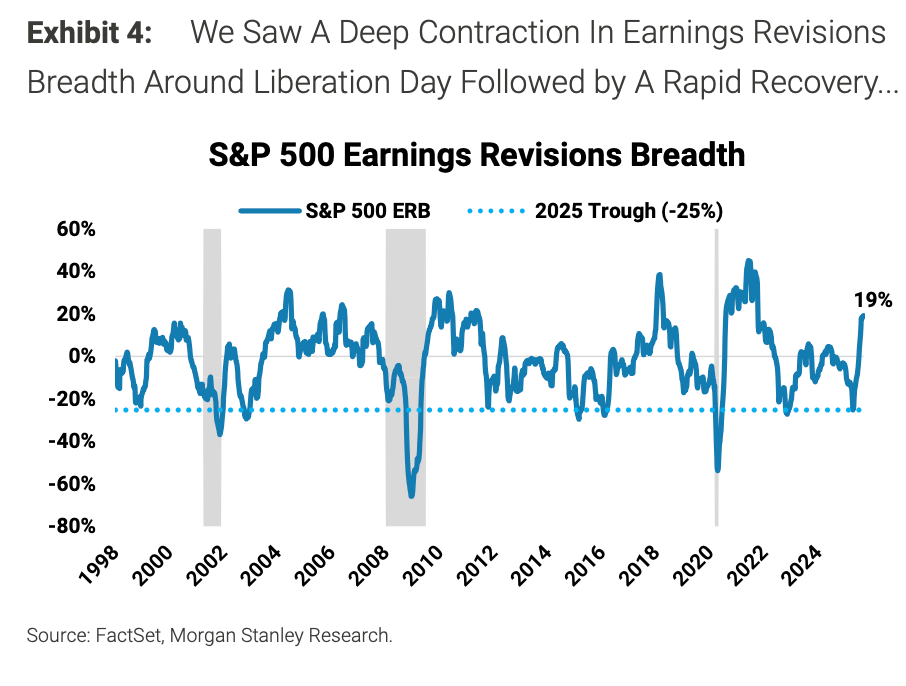

Morgan Stanley points to April 2025, when the White House announced new tariffs in a move dubbed “Liberation Day,” as the recession’s trough. Around this inflection point, leading indicators like earnings revisions breadth—a proxy for corporate guidance—showed dramatic, “v-shaped” rebounds for the first time since early pandemic recovery. Payroll revisions and job cut data also corroborated the bottom, peaking last spring and declining since.

“History suggests these revisions are pro-cyclical, getting more negative going into a recession and more positive once the recovery has begun,” strategists note. “It appears this time is no different.” The latest month’s sharp rebound in payroll revisions supports the view that the rolling recession is over, Wilson wrote, ushering in a new early-cycle environment.

Morgan Stanley’s team argues that headline economic data—nominal GDP, broad employment numbers—lag reality and often miss serious underlying weakness. Classical models failed to spot the recession’s rolling nature because sectors fell and recovered at different times. Government hiring further masked private-sector pain, and supply-chain disruptions, consumer confidence drops, and persistent negative median earnings growth painted a truer picture.

Wilson argues that looking at earnings growth as well as consumer and corporate confidence surveys is a “better way to measure the health of the economy.” By those metrics, earnings growth has been negative for most companies over the past roughly three years, Wilson argues, and the V-shaped rebound in earnings revisions upward shows that corporate confidence “has improved materially since Liberation Day.”

Bull market ahead?

Morgan Stanley projects the Federal Reserve’s rate cuts—already underway from a 100 basis point cut triggered by labor weakness last summer—will power a durable rebound. The new cycle, strategists argue, “is setting up a strong finish into both year-end and 2026,” provided monetary policy remains responsive enough to support growth.

The equity strategists recommend “strapping in” for volatility in coming months as seasonal choppiness and monetary uncertainty persist, but ultimately forecast broad-based earnings recovery and new all-time highs, especially as the Fed’s cutting cycle commences firmly. Sectors like large cap healthcare, in particular, offer defensive value and earnings momentum in this transition, while small caps may catch up later as recovery broadens.

Morgan Stanley’s call marks a shift in how Wall Street interprets “recession.” Rather than a single event, downturns may come in waves, peaking at different times across the economy. For investors, the end of this rolling recession signals not only relief but renewed opportunity: the next bull market is now taking shape as fundamentals improve and monetary conditions turn supportive.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.

Credit: Source link