The narrative surrounding the “resilient U.S. consumer,” which has been a major upside surprise in 2025, is now facing significant headwinds, according to the Global Investment Committee (GIC) at Morgan Stanley Wealth Management. While consumer spending has maintained a steady nominal growth rate of 5% to 6%, underpinning a bullish outlook for US equities in 2026, the GIC is expressing caution.

Lisa Shalett, chief investment officer and head of the GIC, warned that although the broader macroeconomic picture remains cautiously optimistic, the “K-shaped” economy demands greater scrutiny. Specifically, she wrote on Monday that she sees “genuine cracks for mid- to lower-end consumers,” a cohort critical to aggregate growth. They may only account for 40% of consumption in the economy, she noted, but they make up the bulk of marginal growth in the consumption that drives the national economy. Consumer spending, after all, is roughly two-thirds of national GDP, a relationship that has been challenged in 2025 by the massive surge in data-center spending.

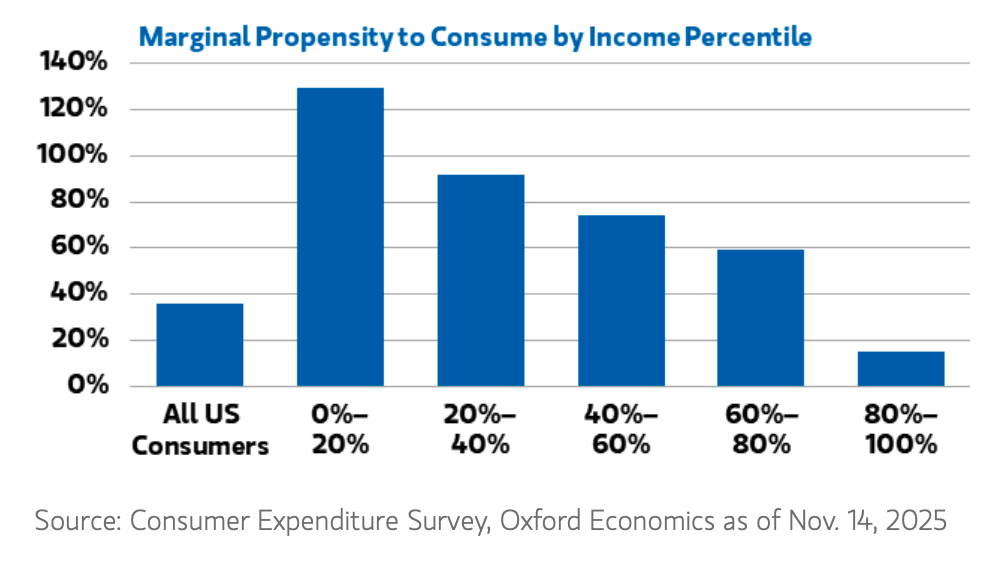

Shalett cited Oxford Economics data in arguing that the marginal propensity to spend an incremental dollar of earnings is more than 6x higher for the lowest-income quintile compared to the wealthiest cohort, making the 2026 outlook “increasingly fragile” without their continued strength. In other words, the economy only really grows at a healthy rate the more money lower- and middle-income people have to spend, and that’s more and more endangered.

The Fragility of Consumption Growth

Consumer spending has sustained a solid three-year trend, Shalet pointed out, driven largely by positive wealth effects benefiting the top two income quintiles, who own 80% of stocks. However, the lower 60% of households by income are now facing rising pressure, potentially altering the outlook for 2026.

She wasn’t alone in voicing concern as two other top Wall Street analysts chimed in on Monday, David Kelly of JPMorgan Asset Management and Torsten Slok of Apollo Global Management. The K-shaped economy—and the crucial issue of affordability—remains a big question mark for the national economy.

Kelly argued in a separate note that while the economy is doing better for everyone, it just doesn’t feel that way. Likening the economy to the hands of a clock, he said the data shows a story of boring, consistent growth, with the wealthy doing better but with the vibes getting rougher.

“The reality of today’s economy is like thirteen minutes past one on an analog clock,” he wrote. “The little hand, representing the fortunes of the top 10%, points sharply upwards and to the right. The big hand, representing the progress of everyone else, is also pointing up, but only mildly so. However, it feels like a twenty past one recession, with the little hand still pointing up but the big hand pointing down.”

Kelly cited the September University of Michigan consumer sentiment survey, in which 45% said that they and their families were worse off than a year ago. “More Americans feel that they are going backwards in economic terms than believe they are moving forward.”

He wrote that JPMorgan believes the expansion is still happening, with real GDP likely growing at roughly a 3.0% annual pace in the third quarter and likely to keep growing in 2026, albeit with growth slowing close to 0% in the fourth quarter. That being said, he highlighted some groups experiencing significant economic stress: federal workers dealing with a “tide of downsizing since the start of the year,” younger Americans facing high housing costs and often significant student debt, and the roughly 24 million Americans on the ACA marketplace facing a doubling of insurance premiums in 2026.

Kelly estimated that 43 million Americans currently have federal student loan debt with an average balance of $39,000, “while the median age of first-time home-buyers is now an astonishing 40. Not coincidently, the median age of first marriage has increased from 22.1 years in 1974 to 29.4 years 50 years later.”

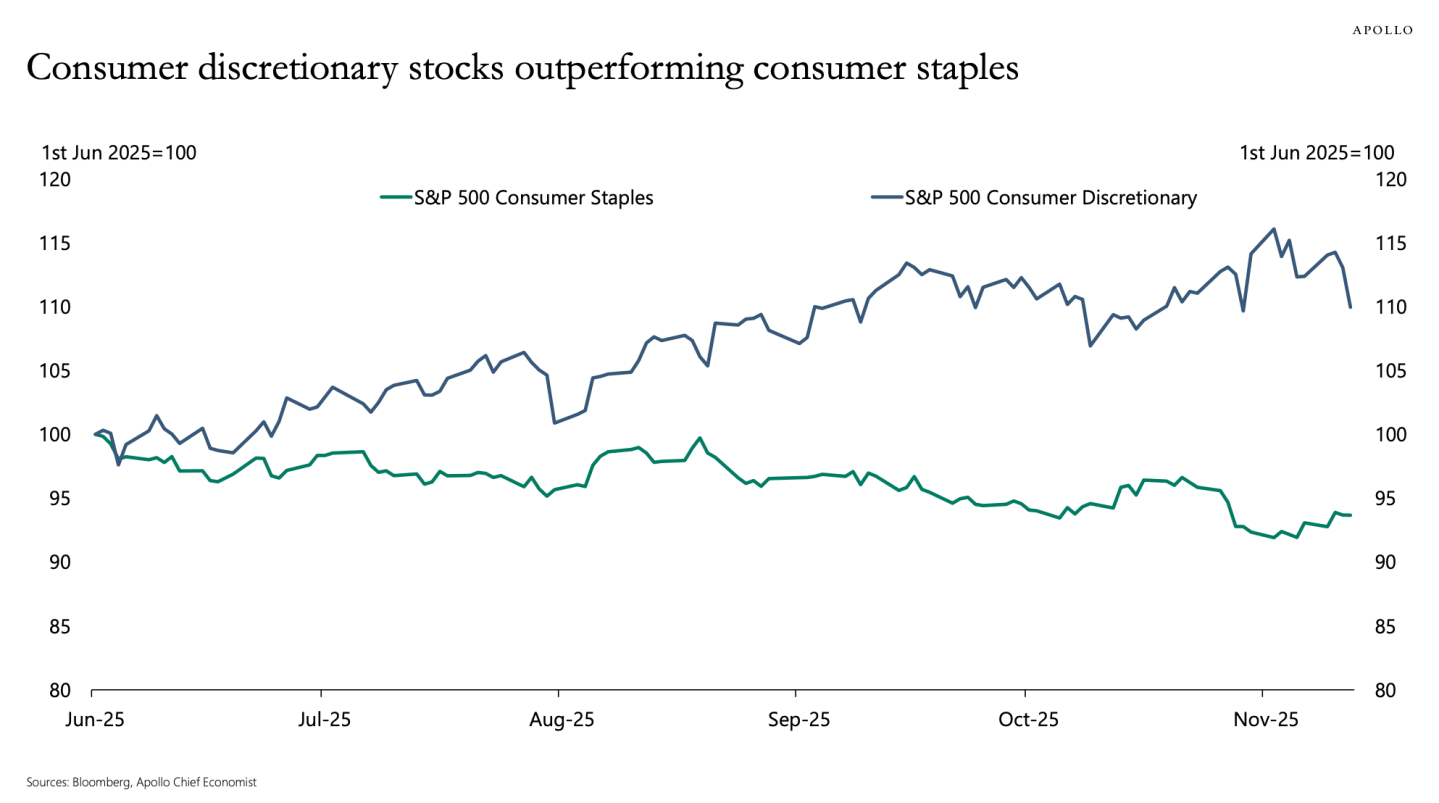

Slok, of Apollo Global Management, wrote in his Daily Spark on Monday that “it is a K-shaped economy for U.S. consumers,” noting that stock holdings and home prices have increased for wealthier Americans, while the cash flow received in fixed income, including private credit, is near the highest levels in decades. This strength in higher-income household balance sheets can be seen in stock prices, he noted, with consumer discretionary stocks outperforming consumer staples in recent months. In other words, the stuff the rich can buy is valued higher by Wall Street than the stuff people need to buy.

3 cracks to watch

According to Shalett, the risk of slowing GDP growth in 2026 hinges on whether the consumer begins to “wilt,” an outcome suggested by recent data. She added that the GIC is monitoring three key factors highlighting stress in the lower-income brackets.

1. Mounting Credit Stress and Delinquencies

Credit stress is beginning to “flash yellow” for this cohort. The overall savings rate has dipped significantly to 4.6%, resting well below the 40-year average of 6.4% and the 80-year average of 8.7%. Simultaneously, delinquencies are surging.

In auto lending, subprime 60-day delinquencies have reached 6.7%, marking the highest level since 1994. Although total household debt grew in line with real disposable income (about 4% in Q3 2025), credit card balances grew at twice that pace, hitting 8%. The latest data shows 30-day past-due credit card payments running at 5.3%, an 11-year high, alongside surging student debt defaults.

2. Affordability Crisis

Mid- to lower-income households are struggling with an “affordability crisis” catalyzed by persistently high price levels and a stable 3% inflation rate that conceals a “whack-a-mole” pattern of price spikes. These spikes have specifically impacted necessities like eggs, coffee, electricity, auto insurance, and health care. Compounding this issue, wage growth—as tracked by the Indeed Wage Tracker—slowed to 2.5% in September, diminishing consumers’ ability to outrun inflation.

3. Deteriorating Labor Sentiment

Employment-opportunity sentiment is weakening. Job openings have fallen to 7.2 million, returning to pre-COVID levels and establishing a 1:1 ratio of openings to job seekers. Furthermore, announced layoffs spiked in October, suggesting the worst year-to-date layoff trend since the Great Financial Crisis.

Consumer sentiment and job anxiety metrics have been particularly troubling. The University of Michigan’s monthly survey for November registered one of the lowest overall consumer confidence readings in the last 73 years, and expectations for employment one year from now saw the lowest reading since 1980. Anxiety linked to GenAI job replacement is clearly a factor, even among high-income workers.

The GIC advises investors that the premise of 2026 being a year where “a rising tide lifts all boats” cannot materialize without strength reaccelerating among the mid- to lower-end U.S. consumers. If the pressure on the lower 60% of households continues to rise, it could lead to slowing retail sales and real disposable income, presenting a material threat to aggregate spending growth.

Credit: Source link