The Treasury Department announced plans Wednesday to accelerate the size of its auctions as it looks to handle its heavy debt load and with financing costs rising.

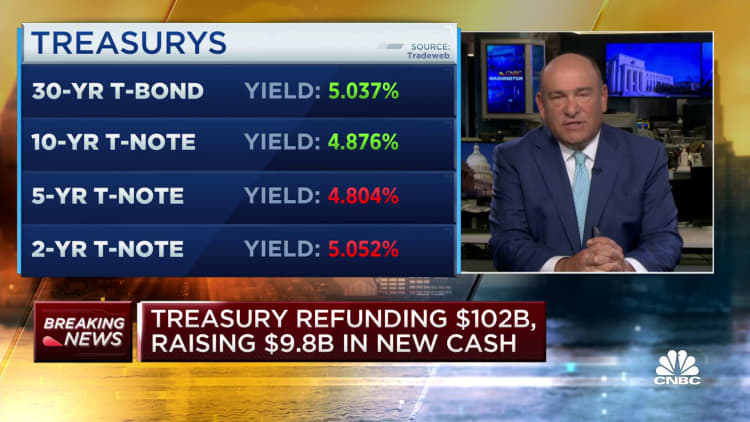

In a development getting close attention on Wall Street, the department detailed its refunding plans for future debt sales. The announcement comes with Treasury yields around their highest levels since 2007, a reflection of financial markets spooked over how much damage higher borrowing costs could exact.

Most immediately, the Treasury will auction $112 billion in debt next week to refund $102.2 billion of notes set to mature Nov. 15, raising more than $9 billion in extra funds.

The sale will come in three parts, starting Tuesday with $48 billion in 3-year notes, with subsequent days featuring respective sales of $40 billion in 10-year notes then $24 billion in 30-year bonds. The total sale matched some estimates around Wall Street in recent days.

From there, the department said it will increase the auction size of various maturities, focusing more on coupon-bearing notes and bonds. The Treasury will maintain its current auction size for bills until late November, when it expects to have its general account replenished enough to implement “modest reductions” through mid- to late-January.

For auctions on coupon securities, the department detailed a step-up in the pace from previous levels, while it said longer-dated debt would increase at a “more moderate” rate.

The Treasury expects to increase the sizes for 2- and 5-year notes by $3 billion a month, the 3-year note by $2 billion a month, and the 7-year note by $1 billion a month. By the end of January, the auction sizes will show respective increases of $9 billion, $9 billion, $6 billion and $3 billion.

Stock market futures came off their lows of the morning following the announcement, while Treasury yields were lower.

On Monday, the department said it would need to borrow $776 billion in the current quarter and $816 billion in the first quarter of calendar 2024.

The auction changes are important to investors because they could provide a window into where yields are heading. Markets have been concerned about whether there will be enough demand to meet the Treasury’s needs, which would send yields up even further and possibly cause financial distress.

However, most auctions have been fairly well subscribed of late, though yields are still around their highest levels since 2007, the early days of the global financial crisis.

Treasury officials have been attributing most of the rise in yields to expectations for higher growth. However, that in turn has spurred concern that the Federal Reserve will have to keep benchmark rates elevated as it continues to try to bring inflation down to acceptable levels.

A letter accompanying Wednesday’s announcement called the increase in yields “partially a response to stronger-than-expected activity and labor market data.”

“Several factors have likely contributed to the rise in longer-term yields,” wrote Deirdre K. Dunn, chair of the Treasury Borrowing Advisory Committee, and Colin Teichholtz, vice chair of the group.

“For example, strong activity and labor market data, the possibility that the neutral rate of interest is now higher, supply-demand dynamics and the return of a positive ‘term premium’ in long-dated Treasury securities have all likely contributed to a certain degree,” they wrote.

Correction: By the end of January, the auction sizes will show respective increases of $9 billion, $9 billion, $6 billion and $3 billion. An earlier version misstated the order.

Don’t miss these stories from CNBC PRO:

Credit: Source link