- Futures bets on the Nasdaq 100 and the S&P 500 were both pointing strongly up this morning prior to the opening bell in New York, suggesting that some traders think yesterday’s bloodbath in the markets was overdone. The S&P lost nearly a full percentage point yesterday, and the Nasdaq was down 1.47%. Some on Wall Street think the Fed is done cutting rates for the year.

Wall Street is trying to figure out if the AI spending reported over the last couple of days by Meta, Microsoft, Alphabet, and Amazon is a good thing or a bad thing. Amazon was up 13% post-market after it reported strong cloud revenues. But Meta lost 11.33% yesterday after it announced it would issue $30 billion in bonds to fund its plan to spend $72 billion in capital expenditures, mostly on AI and data centers. Microsoft was down another 2.9%, also because its AI spending was greater than investors had expected. Nvidia lost 2%, also.

Until recently, the big tech platforms had funded their AI spending with cash from their balance sheets. But now they’re using debt, and Wall Street is raising an eyebrow. “Investors are increasingly questioning the return on such spending, particularly given Meta’s revenue-to-capex ratio of just 3.02—the lowest among its peers,” Jim Reid and his team at Deutsche Bank told clients this morning.

Morgan Stanley’s Lisa Shalett previously told Fortune that debt was making the AI story more “complicated” and the case for tech stocks was getting “weaker and weaker” because of it.

No Fed cut?

In the background, some analysts are now resigned to the notion that Fed chair Jerome Powell’s remarks on Wednesday were gloomier than expected and that there may not be another interest rate cut in December. The CME FedWatch tool—which tracks bets on future Fed rates—has 66% expecting a December cut and 33% predicting no cut. That’s an unusual level of uncertainty. By comparison, Wall Street had a 99.9% certainty of October’s cut prior to the announcement.

At Bank of America, Claudio Irigoyen and Antonio Gabriel told clients they believed this was “The end of the cutting season” for a swathe of major central banks. “It seems this is it for the 2025 easing season in developed economies. The Fed and the Bank of Canada cut 25bp but signalled a likely pause until next year, in line with our view. The ECB didn’t bend on the dovish side and now we expect the next cut in March. Finally, for next week, we expect the Bank of England to remain on hold and we don’t forecast cuts until March. In Australia, we expect RBA to remain on hold for an extended period of time,” they said.

Macquarie’s David Doyle and Chinara Azizova also don’t see another Fed cut in December, according to a note seen by Fortune.

“Fail risks”

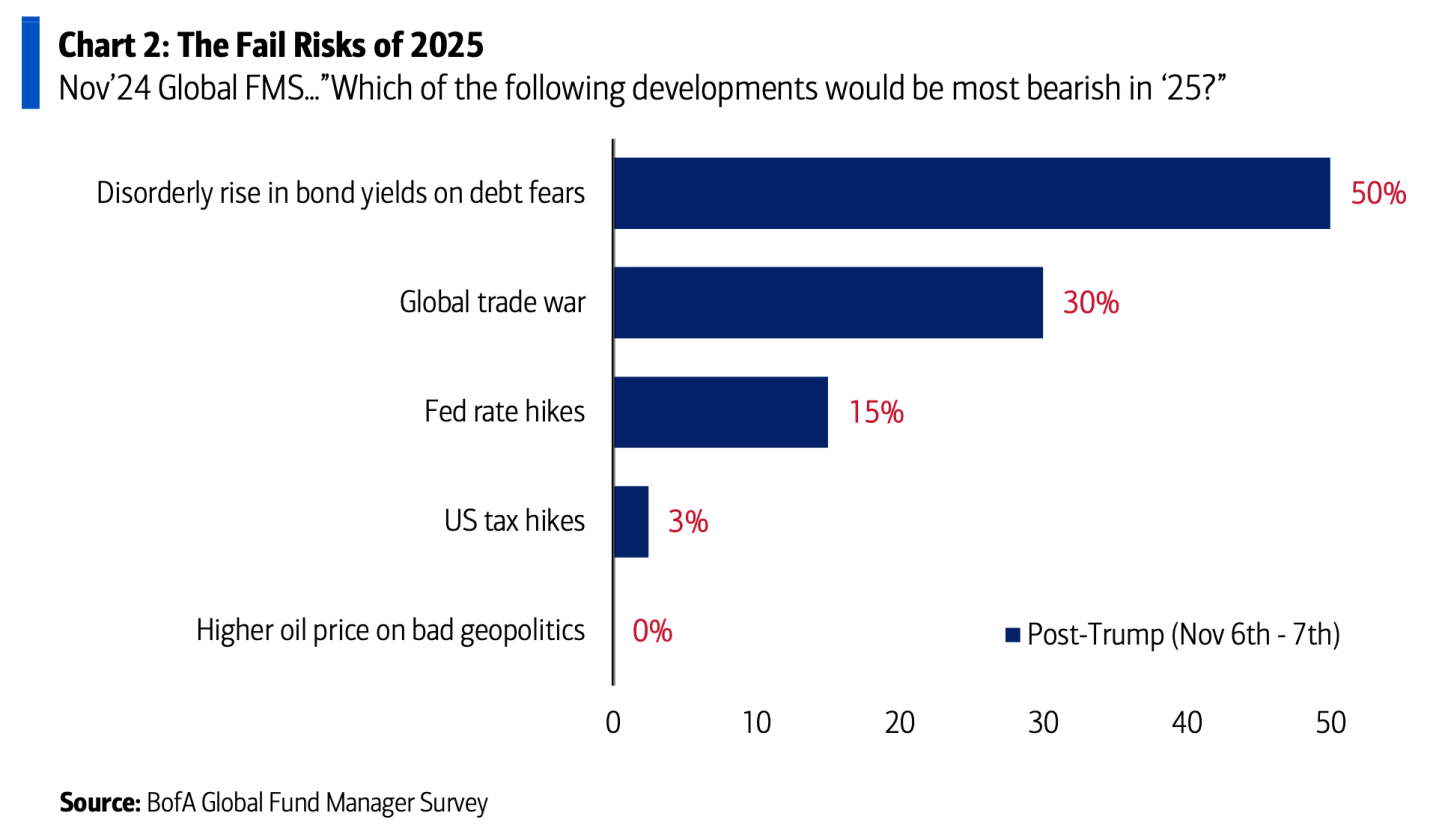

With no promise of cheap new money coming from central banks, and tech investors split on whether AI spending is bullish or bearish, BofA published the results of its monthly fund manager survey. Some of its results should be taken with a pinch of salt, such as this summary of the “Zeitgeist”: “‘I’m long AI, and voting Mamdani,’ 20-something Brooklyn math teacher.”

More seriously, investors were asked to rank their worries for the future. 50% cited “Disorderly rise in bond yields on debt fears” as their biggest “fail risk.” (Fortune has written about anxiety over a potential government bond crisis here.) 30% cited the trade war.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were up 0.72% this morning. The last session closed down 0.99%.

- STOXX Europe 600 was down 0.24% in early trading.

- The U.K.’s FTSE 100 was down 0.42% in early trading.

- Japan’s Nikkei 225 was up 2.12%.

- China’s CSI 300 was down 1.47%.

- The South Korea KOSPI was up 0.5%.

- India’s NIFTY 50 was down 0.5%.

- Bitcoin was flat at $110K.

Credit: Source link